Pricing Options on Foreign Currency with a Preset Exchange Rate

Full text

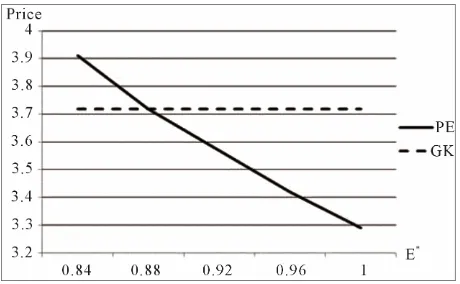

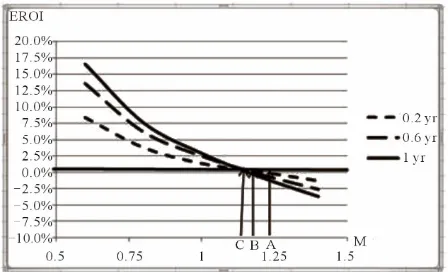

Figure

Related documents

The listing of specific powers is extensive, and culminates with the power “[t]o make all laws which shall be necessary and proper for carrying into execution the foregoing

Fusce dapibus, tellus ac cursus commodo, tortor mauris condimentum nibh, ut fermentum massa justo sit amet risus. Cras justo odio, dapibus ac facilisis in, egestas

Our main results indicate the presence of flypaper effect and it seems that in municipalities with larger share of elderly population, high school spending responds less to

The scope of the study is shaded in grey and in green. In PNG there are separate but overlapping qualification frameworks for higher education and for TVET. Qualifications at

It is no surprise that skills development is a central part of most industrial sector strategies – raising levels of workforce skills, particularly science, technology,

Architecture & Planning Research, and the Journal of Social Issues (Not all of these are available in full-text through ISU's databases). A good strategy to find a

We chose four different file sizes here (8 KB, 64 KB, 512 KB, and 4 MB) as representative of small flow mea- surements. For simplicity, we focus on one cellular carrier, AT&T

Our findings also empirically demonstrate the risk that say on pay vot- ing may exacerbate, rather than eliminate, problems with executive pay structure. We show that