Foreign Direct Investment (FDI) and Nigerian Economic Growth

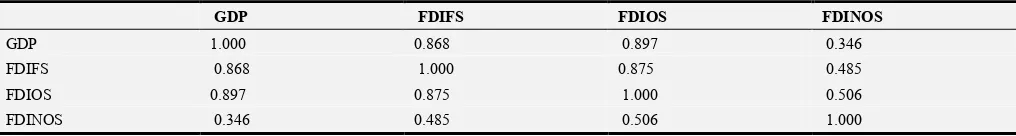

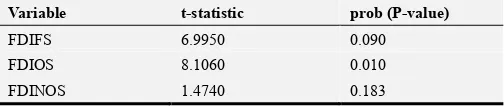

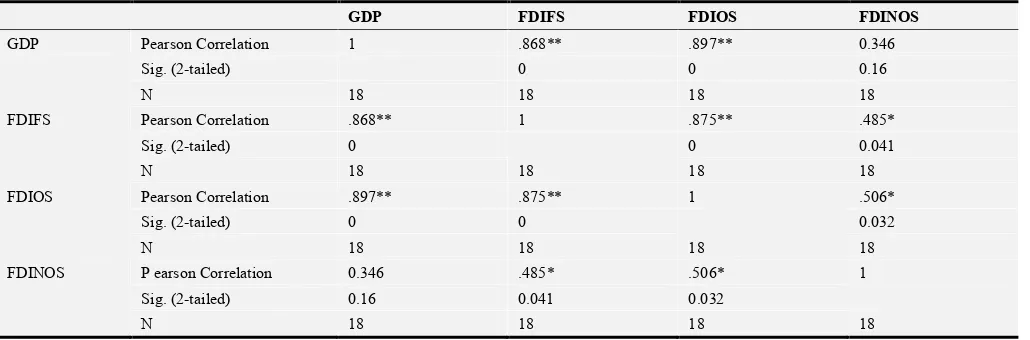

Full text

Figure

Related documents

From the results of the assessment of the hierarchy that has been prepared, it can be concluded that the main problem in managing solid waste in Tarakan City is the lack

A comprehensive finished product specification is provided for the film coated tablet that includes HPLC assay, identity of Zopiclone by HPLC and TLC and control of

Treated surface profile at 7.500X Biotec-BTK uses grade 4 pure titanium to produce implants and grade 5 titanium.. (Ti6Al4V) for prosthetic components: both are certified according

If African Americans are going to pursue a degree in Math, Science, Technology, Engineering then they need to have the courses from High School in order to persist.. The courses

The Notice was sent to all the Members, whose names appeared in the Register of Members as on 15'~ ~ecember, 201 7 (cut-off date), who were entitled to vote on the proposed 1

The deterministic dynamic programming model begins its run after the time horizon shifts forward M days, and it assumes the demand for R days is known; that is, this

Where buildingSMART (former IAI) started in 1995 Arch Struc MEP Curt Cost PM Cont FM Arch Struc MEP Curt Cost PM Cont FM Shared Builing Model. The painful reality The

Continue to enforce the wetland district provisions of the zoning ordinance, and update as necessary to incorporate new provisions of the 2008 WRMP and