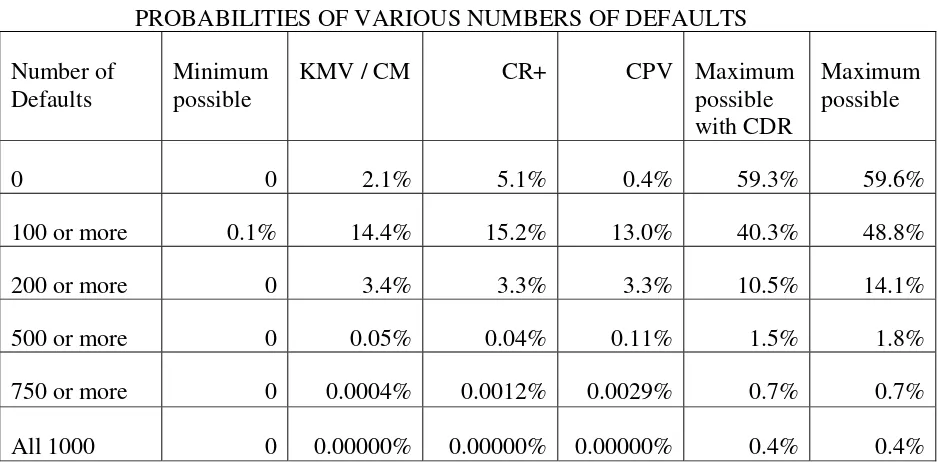

Severe Loss Probabilities in Portfolio Credit Risk Models

Full text

Figure

Related documents

The aim of this article is to deliver potential solutions by analyzing what happened over time in Europe in terms of general thinking about escrap, the current status and the

Overall, this research has demonstrated that obesity has a significant impact on the Australian economy and that the estimated cost represents significant potential savings

Column D Current Certification The principal agent certifies the current valuation amounts and items of expense and/or loss {detailed in the recovery statement } as well

In consideration of publication of an advertisement, the advertiser and the advertising agency will indemnify and hold harmless the airline, the Publisher, the magazine,

wide – Mobile communication network coverage Basic monthly charge and billing per SMS message – • Connection of Ethernet networks • Connection of substations • Worldwide

The Portfolio Analytics, Risk and Implementation Team (PARI) at STANLIB provides an oversight function via a consistent and unbiased process for evaluating investment risks.. The

Abstract: This article extends the framework of Bayesian inverse problems in infinite- dimensional parameter spaces, as advocated by Stuart ( Acta Numer. 19:451–559, 2010) and

PII is an identification mechanism based on the images selected by the user at the time of enrollment.If the same image is selected by the user at the time of verification then