Option pricing with Legendre polynomials

Full text

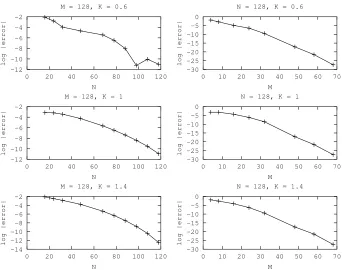

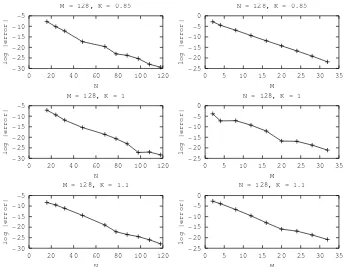

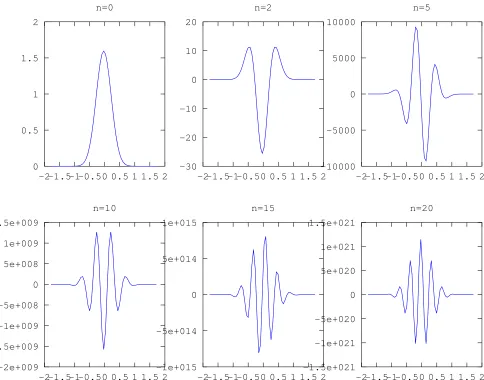

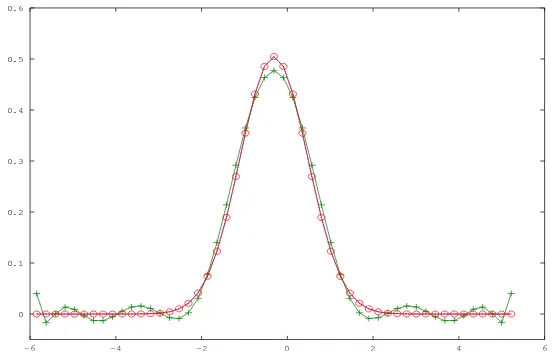

Figure

Related documents

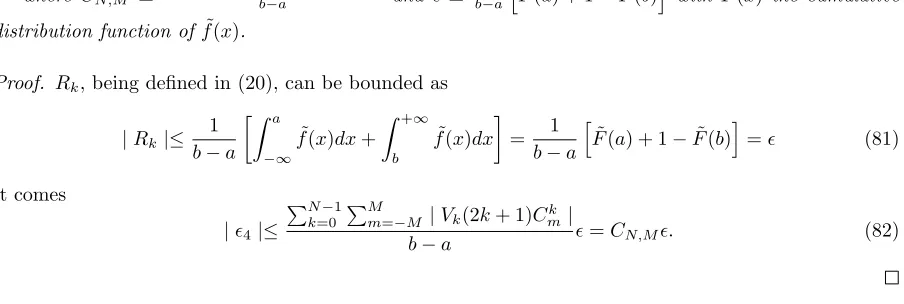

In Section 2, we use perturbation theory of PDEs to derive an asymptotic expansion of the European vanilla option price when the elasticity parameter of the CEV diffusion is close to

By multiplying the option price function by an exponential function to ensure the integrability of the Fourier transform the pricing problem is effectively

Insurance and financial option contracts; insurance and option pricing theory; complete and incomplete markets; dynamic hedging and no-arbitrage; risk-neutral martingales;

We evaluate three European call option pricing models: the constant decision rule pricing model (CON-ECO), the linear decision rule pricing model (LIN-ECO), and the piecewise

We report the statistical significance of pricing errors between the semiparametric option pricing model with liquidity (WL) and the semiparametric option pricing model

Option Pricing for Jump Diffusion Processes Recently Pillay and O’ Hara [3] have studied the FFT sed option pricing under a mean reverting process with stochastic volatility

Secondly, we price the option price using fast fourier transformation for L´evy process since it is easy to find the characteristic function for most of the L´evy

Section 3.1 describes a very useful formula for pricing exchange options, while Section 3.2 gives a model for the FX market, where the option could be directly an FX option or an