Option Portfolio Management in a Risk Neutral World

Full text

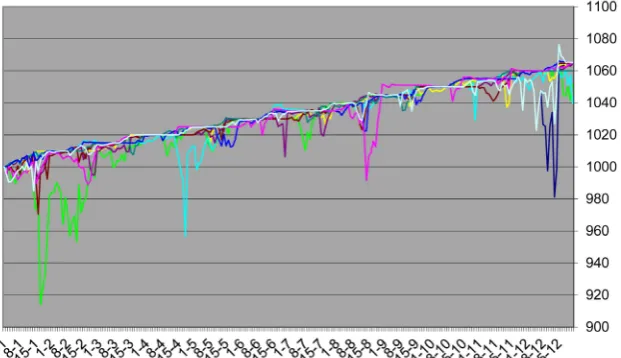

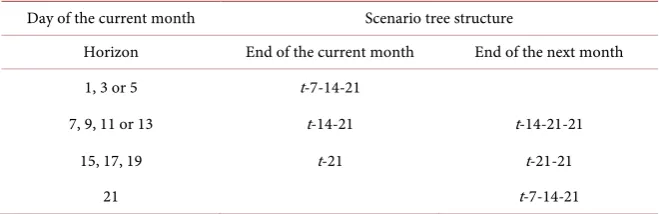

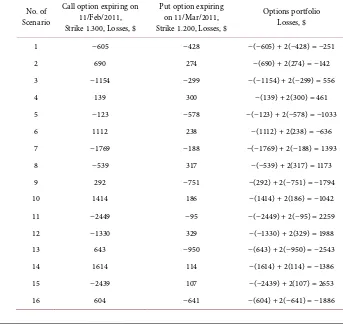

Figure

Related documents

Lastnik restavracije ima tako kot zaposleni poleg moˇ znosti pregledovanja in urejanja naroˇ cil ˇse dovoljenja za urejanje osnovnih podatkov o restavra- ciji, zaposlenih in

Short-circuit protection Conforming to EN/IEC 60947-5-1 A Standard block with screw clamp terminals: 10 (gG cartridge fuse conforming to IEC 60269-1). Rated insulation

Does substance abuse treatment affect recovery capital and level of self- efficacy to abstain from alcohol use during the first year of

AbstrACt: The aim of this study was to investigate the approaches toward learning of undergraduate Physiotherapy students in a PBl module to enhance facilitation of learning at

To investigate whether state-level rates of economic growth did in fact increase following branching deregulation, 24 we estimate the change in the average growth rate of two

We have compiled and collected data on the serious health effects of gas drilling, hydraulic fracturing (e.g., fracking) and production on Texans throughout the Barnett Shale; water

The Developing Framework On The Relationship Between Market Orientation And Entrepreneurial Orientation To The Firm Performance Through Strategic Flexibility: A

The groups of data or bins are plotted on the x−axis and the frequency of the bins is plotted on the y−axis. A grouped frequency distribution is constructed for the numerical data