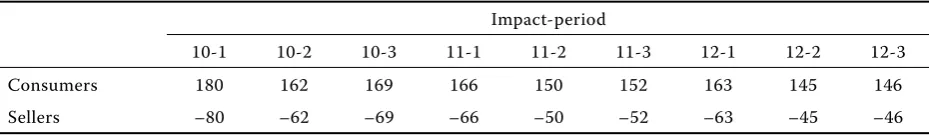

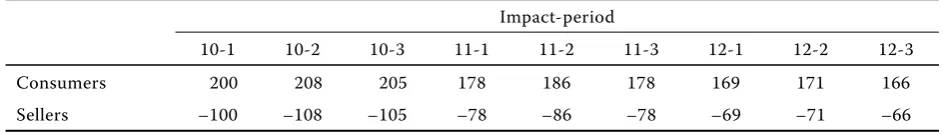

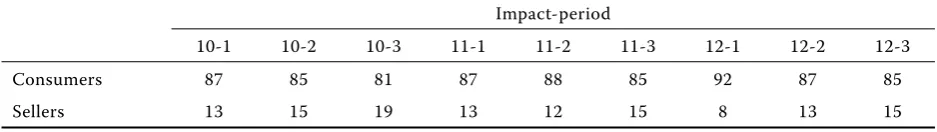

Distribution of the increased tax burden for agricultural products and food in the Czech Republic

Full text

Figure

Related documents

• Follow up with your employer each reporting period to ensure your hours are reported on a regular basis?. • Discuss your progress with

National Conference on Technical Vocational Education, Training and Skills Development: A Roadmap for Empowerment (Dec. 2008): Ministry of Human Resource Development, Department

Field experiments were conducted at Ebonyi State University Research Farm during 2009 and 2010 farming seasons to evaluate the effect of intercropping maize with

There are infinitely many principles of justice (conclusion). 24 “These, Socrates, said Parmenides, are a few, and only a few of the difficulties in which we are involved if

19% serve a county. Fourteen per cent of the centers provide service for adjoining states in addition to the states in which they are located; usually these adjoining states have

Twenty-five percent of our respondents listed unilateral hearing loss as an indication for BAHA im- plantation, and only 17% routinely offered this treatment to children with

This paper presents an ID-based modified mutual authentication key agreement protocol based on elliptic curve cryptography.. In this protocol, two entities which