Influence of Merger on Performance of Indian Banks: A Case Study

Full text

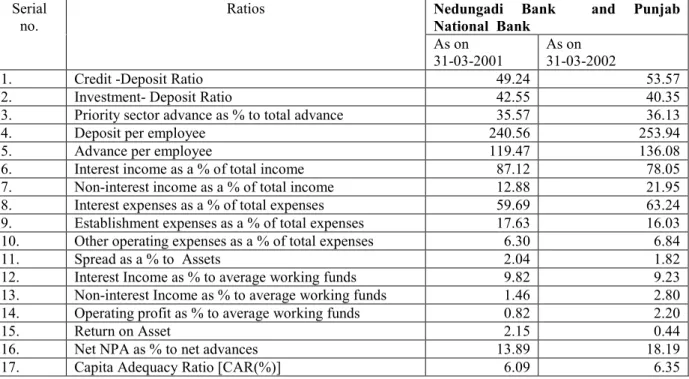

Figure

![Table 5:- Mean and Standard Deviation of Pre-merger and Post-merger Ratios of combined (Nedungadi Bank Ltd and Punjab national bank ) and Acquiring Bank (Punjab national bank)[considering two year pre and post]](https://thumb-us.123doks.com/thumbv2/123dok_us/1258496.2669317/8.892.101.799.178.827/standard-deviation-combined-nedungadi-national-acquiring-national-considering.webp)

Related documents

In case of public sector bank, State Bank of India (SBI), for private sector bank, Industrial Credit and Investment Corporation of India (ICICI) bank and for

To evaluate the comparative financial performance of Bank of Baroda and Punjab National Bank, the study adopted the world-renowned: Capital Adequacy, Asset

The amalgamation scheme includes the merger of Indian Bank with Allahabad Bank; Oriental Bank of Commerce (OBC) and United Bank of India with Punjab National Bank (PNB); Canara

Alongwith the steep rise in the investments of FBs, the share banks and investment to deposit ratio of FBs, has gone up considerably while credit to deposit ratio of the same

From public sector banks namely, the State Bank of India, Punjab National Bank, IDBI Bank, Bank of India, Bank of Baroda, Union Bank of India, Canara Bank,

To evaluate the Credit - Deposit ratio of both HDFC Bank and IDBI Bank in order to ascertain the Deposit – Lending pattern of both the banks during the study

Under credit risk performance of the bank, real common equity to total assets ratio is 8.95 per cent in 2011 and has slightly increased to 9.15 per cent in 2015, resulting in

In the present study five internal factors (size of the bank, return on assets, advances to deposits, credit deposits ratio, operating profit to total assets and