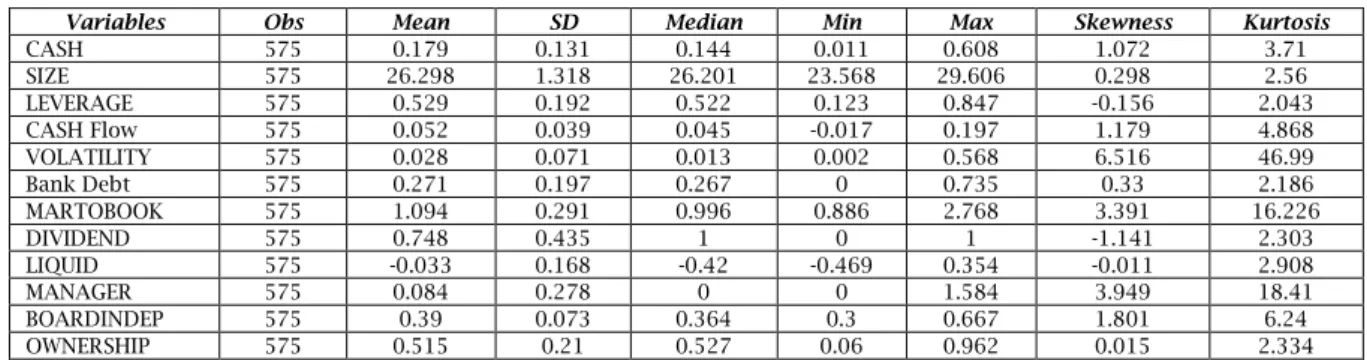

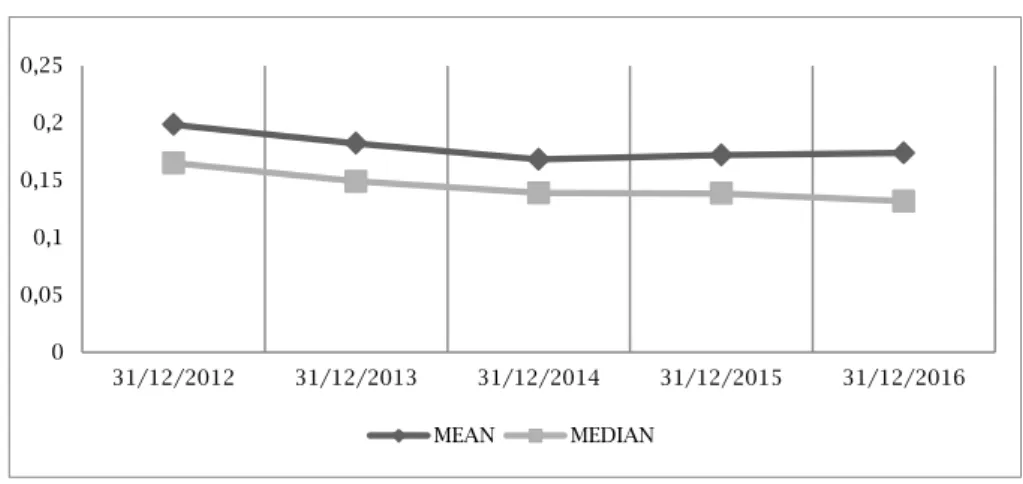

Determinants of corporate cash holdings: An empirical study of Chinese listed firms

Full text

Figure

Related documents

The objective of the present study was to investigate effects of adding an exogenous xylanase enzyme at dif- ferent application rates on feed intake, ruminal fermen- tation, total

As the role of the ECB has been merely addressed studying the policy rate pass-through to lending rates, we offer a novel perspective assessing the impact of debt

First, we investigate the consequences of higher individual income risk and lower downpayments, and find that these two changes can explain, in the model and in the data, the

In the field of professional services, three societal effects of Bangladesh are evident, namely, the low level of professionalism, the low-audit fees associated with

SUMMARY OF THE ARGUMENT ... Retaliation from Traffickers is a Very Real and Common Threat Faced by Survivors of Trafficking. Although Respondent Should not be Required to

The fifth part is the conclusion Outlook and management suggestion of this paper, the supply chain financial risk control in the pre-loan supply chain financial overall

The blog is the primary way for students to complete their Article of the Week assignment that is a simple weekly one page reading assignment with typical questions of title,

This will include Upfront Research about the category (size, growth, segments, trends, competitive products), concept boards, Marketing Research among target consumers to refine