Why You Should Prefer Low Volatility ETFs Gil Cohen *

Full text

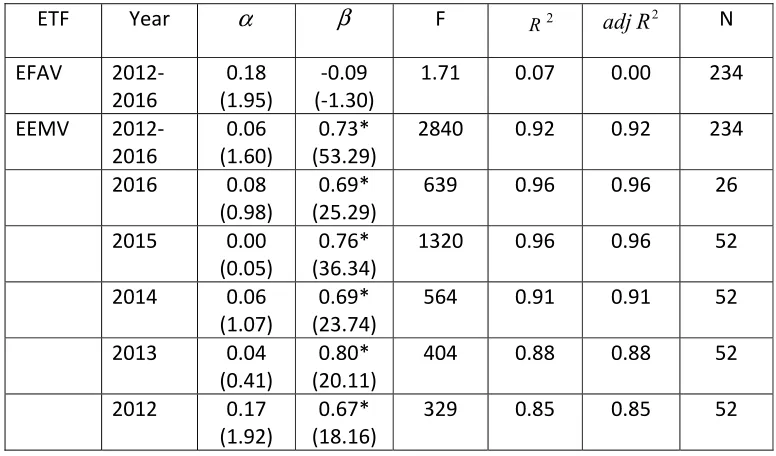

Figure

Related documents

More than for any category of foods, rigorous scientific studies have shown that consumption of soft drinks is associated with poor diet, increasing rates of obesity, and risk

To test the method, a neural network is trained using simulated radar data and then a measured radar dataset is inverted and the results compared to those from a directional wave

a) According to Building Code & Bushfire Hazard Solutions, trees within the APZ for the proposed science building would be able to be retained without compromising the

Na njihovo posredovanje je odgovorila Vlada Republike Slovenije, ki je zagotovila, da bodo začeli z gradnjo, razpis za izvajalca je bil tako objavljen leta 2017.18 Drugi največji

The education data consist of outcome measures enrollment rates in primary or elementary school, as well as in secondary school, and test scores and resources used in producing

Consider many factors when assessing the occurrence and potential for excessive vegetative growth including, growth stage, growth rate, fruit retention, availability of

UC also used his own site (whose home page he used as “home” for IE) as a jumping off point. New URLs of interest were stored as Favorites. URLs that had “proven themselves”

ABSTRACT: The performance of pile foundations under axial compression loading can be rationally evaluated within an elastic continuum framework using field results from