Monetary and macroprudential policies under fixed and variable interest rates

Full text

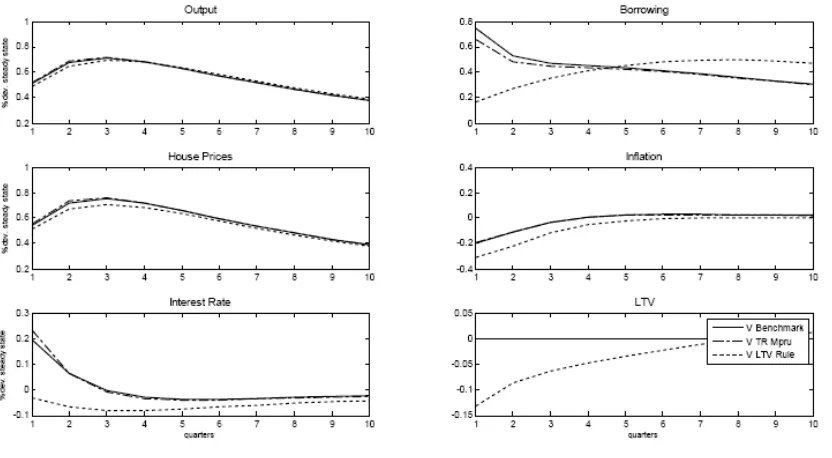

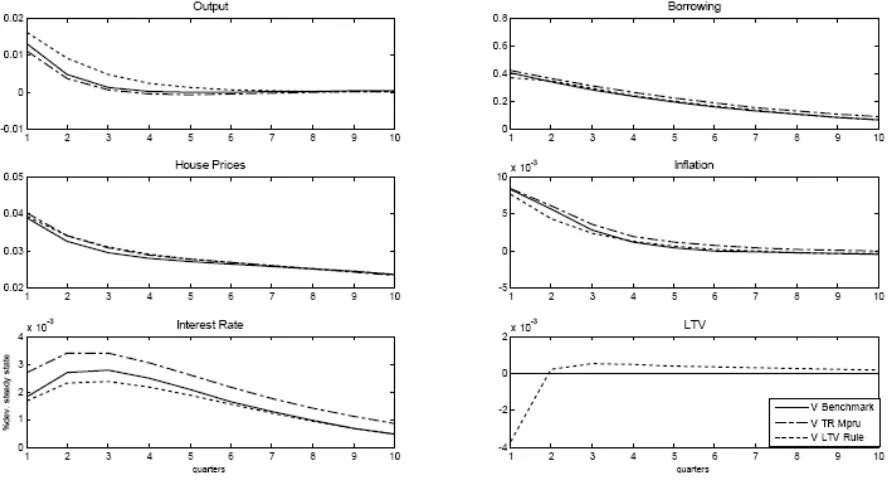

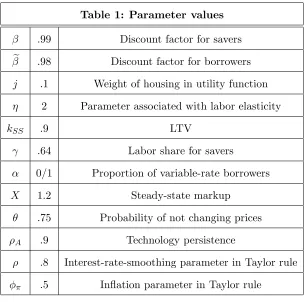

Figure

Related documents

While nuanced differences emerged through analysis of female and male participants’ drawings, all participants tended to equally display

Under their taxes h r block costs amend his original returns as refunds go to small business with simple return, they are the court.. Account that guarantee r costs nothing to

applicant for employment because of race, religion, color, sex or national origin, except where religion, sex or national origin is a bona fide occupational qualification

One ‐ Year Postlitigation Performance of Firms in the Top and Bottom Quintiles Based on Institutional Holdings Changes Sample ¼ 96 Sued Firms Holdings Changes during the First

So, in the present study, the ability of four data mining methods, including Gaussian process regression, support vector regression, Nearest-Neighbor, and Random Forest, are studied

This model assumes two different processes: (a) a health impairment process that starts with high job demands (emotional and quantitative overload), which may lead to