Measuring Liquidity Risk in an Emerging Market: Liquidity Adjusted Value at Risk Approach for High Frequency Data

Full text

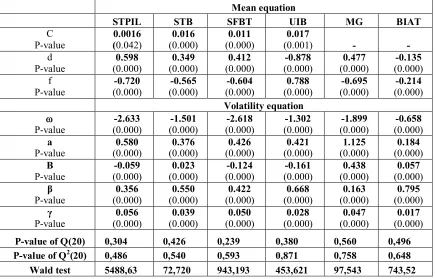

Figure

Related documents

This study examines 50 countries over the years 1978- 1993 and finds in a pooled two stage least squares modeling exercise that the Fraser Institute measure of capitalism appears

government or instrumentality in order to assist the defendants in obtaining and retaining business for, and directing business to, themselves and other Vetco Gray companies, to

coordinators, in an IPO of shares and GDRs by Acron, a leading Russian and global mineral fertilizer producer, with a listing of the GDRs on the London Stock Exchange and a

Al Yusr Morabaha and Sukuk Fund (Managed by Alawwal Invest Company) NOTES TO INTERIM CONDENSED FINANCIAL STATEMENTS (UNAUDITED) At 30 June

Contact information for members will be maintained by the Student Programs Manager and can be made available to the Alpine Club officers upon request.. 8 Student Programs

The learner sees a nonverbal stimulus and hears two different supplementary stimuli, a verbal stimulus and an echoic stimulus, and makes an echoic response.. In the second step,

Μολαταύτα, η αναφορά στο μουσικό του χάρισμα, αν και βραχυλογική, αποτυπώνεται δυναμικά (ᾄσας δεξίως καὶ κιθαρίσας κατὰ τὸν νόμον τῆς τέχνης).

Consumers in Anglo–Saxon and market-based economies, and in countries with more developed mortgage markets and outside the euro area react more strongly to wealth shocks: they