An UGC Autonomous Institution

(Approved by AICTE, permanently affiliated to JNTU, Hyderabad) (NAAC Accredited Institution with ‘A’ Grade)

Vol. 8 No. 3 July-September 2019 (Special Issue)

ISSN (Online) : 2322-0449

ISSN (

) : 2277-6753

Department of Master of Business Administration

Abstract

This paper aims to study the impact of credit risk analysis during the period 2011-2016. In this paper, reference was made to the evolution of credit facilities provided by commercial banks. Search Results:

Most of the bank credit in Yemen is in the form of loans and advances, mostly short-term. Short-term loans and advances in commercial banks accounted for 81% and medium and long-term loans accounted for 19%. Financing is concentrated in short-long-term loans, mostly to finance trade operations in import and trade.

Medium and long-term loans declined due to political and economic instability during the study period. This is due to the commercial banks investing most of their deposits in the public sector in the form of treasury bills in the Central Bank of Yemen because of the high return, which reduced the orientation of these facilities to the private sector where the government sector accounted for about 70% of the total credit compared to 30% for the private sector in general 2014.

Introduction

The phenomenon of bad debts and the inability of debtors to meet their obligations has recently escalated banks and their failure to manage money. As the prevailing economic events are a cause of default, such debts must be viewed in a manner that preserves the common interest of the debtor and the creditor. The phenomenon of bad debts may be considered a banking crisis that has a fundamental impact on the performance of banks.

It has become clear that no bank is exposed to this crisis, unless it is ultimately exposed to loss and high risk, which affects its business reputation and ultimately leads to a decrease in the volume of deposits for customers, resulting in a decrease in the volume of credit facilities granted.

Looking at the situation in Yemeni banks, we see them suffering from the risk of bad debts. And that as a result of the challenges facing the Yemeni economy as a result of the political and economic war banks faced the negative effects of the war from economic stagnation, unemployment, inflation and changes in currency rates, and consequently the Yemeni banking system suffered from the phenomenon of bad debts and bad debts. This phenomenon has become a major problem for all banks.

* Research Scholar, Yemen Email: hussein_alarasi@yahoo.com

Credit Risk and Impact on Credit Facilites in Yemeni Banks

The study of this phenomenon has a negative impact on revenue, liquidity and profitability. Something that to make most banks study their credit policies and procedures to suit the changes preserve depositors 'funds and shareholders' rights in collecting them.

Statement of The Problem

Bad debts have adverse effects on banks in general. Banks are forced to increase annually percentage of provisions for doubtful debts to address this problem.Losses arising from non-payment of these debts also affect the Bank's reserves or capital and its liquidity and thus lead to bankruptcy.Troubled banking facilities have been increasing cumulatively recently in recent years in banks.Or is it the result of banking and financial market conditions and economic changes, or is it the result of what?

Significance

The importance of this study is shown by the following points:

• A serious banking phenomenon is the high volume of bad debts, especially in the authority.Yemeni banking, which negatively affects the profitability of banks and the national economy.

• Its importance also comes in that it contributes to uncovering the true credit standing of operating banks the Yemeni.

Objectives Of The Study

• Identify the most important factors influencing the growth of bad debts, their causes, and their ratings in generalYemeni banking system.

• Identify measures to reduce this phenomenon as much as possible in the light of privacy long live the Yemeni banking system.

• Finding the relationship between the factors affecting credit facilities and bank default. • Attempt to identify the size of bad debts in banks operating in the banking system the Yemeni.

Credit Risk

Credit risks are defined as the risks that when the bank is unable to recover interest and the principal of the amount borrowed or both of them. As a result, it can be said that credit risks are the risks that are resulted of non-payment in full and on date, resulting in a large financial loss (Hample.1999).

loss to the bank (Hanafi &Abuqhafa, 1995).Therefore, credit risk emerges when a bank is failed to recover the lending money from a borrower, counterparty ) Hempel & Simonson,1999).

Based on the forgoing, banking credit risks can be defined as one of the most prominent potential banking risks that banks encounter along with the credit facilities provided to their customers. Moreover, bank credit risks are also resulted of several factors that result in the debtor's failure to fulfill his liabilities to the bank.

Credit Risk can be Divided into Two Types

• Direct credit risks: are the risks of default of the credit amount and its interests and profits and delay in payment.

• Indirect Credit Risk: are the risks associated with the indirect credit such as documentary credit/letter of credit and collaterals, which can turn into direct risks all over the life of the credit and collaterals (Abdul-Aal, 200

Credit Risk Sources

The sources of credit risks come from various sources, including primary sources which are resulted by different activities, such as customer's activity, or by the nature of the financed operations, or by the customer himself, or by the bank's failure or by the common economic and commercial conditions. There are undoubtedly, some internal sources that can be avoided by abolishing the reasons; however, external sources cannot be avoidable since the bank has only one choice that is to deal efficiently with these risks. (Al-Alfi, 1997).

Bad debts: Defaults are defined as a state of imbalance that may affect the state, the organization, the bank, or the individual due to a combination of internal and external causes and variables and lead to the inability to pay the required obligations.)Shahat. 2001).

Bad debts can be divided into

• Debts tainted by various notes require careful follow-up and take appropriate preventive measures, such as those notes delayed payment of premiums more than a month and the failure to complete documents in the file and poor account movement.

• Debts approaching the risk cycle and likely to cause a loss to the Bank for reasons that may be related to the poor liquidity of the borrower or the change in management of these accounts. These accounts require greater welfare but are not necessarily doubtful loans.

Classification of Direct Credit Facilities According to Duration:

Table 1:Direct Credit Facilities in Commercial Banks (Billion Riyals)

Item /year 2011 2012 2013 2014 2015 2016

Short-term loans and advances 132.6 139.6 166.3 163.5 124.7 117 Medium and long term loans 43.1 22.7 21.7 25.1 11.7 6 Investments of Islamic banks 119.6 120.6 218.8 215.4 116.1 89 Loans and classified facilities 79.6 96.0 112.6 132.4 155.3 190.2

Total direct credit facilities 376.5 379.1 519.5 536.6 408.2 402.8

Source: Compiled from the annual balance sheet reports of Yemeni bank

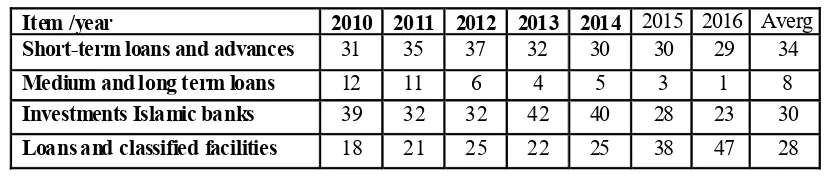

Table 2 : The Relative Importance of Direct Credit Facilities in Commercial Banks %

Item /year 2010 2011 2012 2013 2014 2015 2016 Averg Short-term loans and advances 31 35 37 32 30 30 29 34

Medium and long term loans 12 11 6 4 5 3 1 8

Investments Islamic banks 39 32 32 42 40 28 23 30

Loans and classified facilities 18 21 25 22 25 38 47 28

Source: Calculated based on the table data(1)

The Central Bank of Yemen classifies direct credit facilities in its issuance according to this classification into two categories: short-term credit facilities (one year maximum), medium and long term (more than one year). Table (2 ) shows the increase in the volume of short-term loans from the credit facilities granted by commercial banks during the period studied. This is evident in the data contained in the above table. The total average of these facilities during the period covered by the study is about 34 % of commercial banks are short-term loans, mostly to finance business operations in import and trade of locally produced goods.

The concentration of credit facilities granted in short term financing refers to the ineffectiveness of the discount rate policy in directing credit towards stability and development purposes. It also indicates the low level of credit risk faced by banks, as the level of these risks is linked to a direct relationship with their credit facilities for several reasons. Most notably:

• The ability of banks to identify the expected credit risk associated with short-term credit facilities due to the complex technical frameworks used by banks to determine the creditworthiness of short-term credit facility applicants.

• Short term credit facilities are used to finance current assets, which have a relatively high turnover rate and thus increase the ability of customers to meet their obligations to banks based on the cash flows generated by the rapid turnover of current assets, not based on net profits generated from operating fixed assets if directly financed.

• -Short-term facilities are granted at relatively small and periodic levels consistent with the requirements of strategic stock levels. This measure would ease credit risk by reducing credit concentrations.

• The table shows the decline in medium and long-term loans, which did not exceed 8 % on average during the study period, due to the economic instability during the study period. Table ( 2) shows that investments by Islamic banks averaged 30 % of the total credit granted by commercial banks. These investments constituted a high percentage of the credit granted to banks. The table ( 2) shows loans and advances classified as increased from 79.6 billion riyals in 2011to 190.2 billion riyals in 2016 with an increase of 110.6 billion riyals. We note the classified debt increased from 18% in 2011 to 47% in 2016 .The average during the study period was 28 %. This increase reflects the increase in the volume of risks faced by banks. This increase is attributed to the political crisis in Yemen.

Classification of Credit facilities by Economic Sector

The productive sectors whether commodity or service, need to finance expansion projects and increase production capacity. Thus, investors in the private and public sectors resort to the banking system to request the necessary credit to meet financial needs. The banking system usually meets the demand for credit to serve economic development within the limits of monetary policy.

Table 3 : Distribution of direct credit facilities granted by commercial banks by economic sectors (Billion Riyals)

Item /year 2011 2012 2013 2014 2015 2016 Agriculture and

Fisheries

9.0 13.9 17.4 16.8 15 20

Industry 57.9 53.1 72.5 99.8 35 60

building and Construction

24.8 31.2 78.3 70.7 56.4 54.8

Trading 211.9 218.2 228.0 238.3 210 183.4 Services 72.6 60.0 123.0 110.9 92.3 84.4 Total 376.5 376.6 519.6 536.6 408.2 402.8

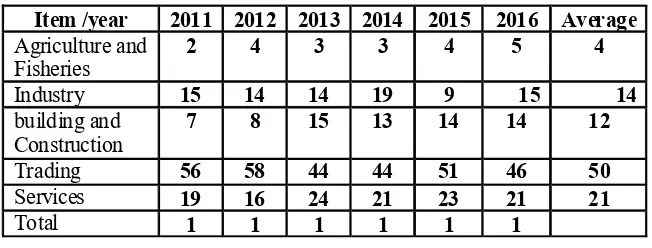

Table 4: Relative importance of the distribution of direct credit facilities granted by commercial banks by economic sectors %

Item /year 2011 2012 2013 2014 2015 2016 Average Agriculture and

Fisheries

2 4 3 3 4 5 4

Industry 15 14 14 19 9 15 14

building and Construction

7 8 15 13 14 14 12

Trading 56 58 44 44 51 46 50

Services 19 16 24 21 23 21 21

Total 1 1 1 1 1 1

Source:Source: Calculated based on the table data (3)

Development of the Agricultural Sector

The ratio of direct credit facilities (loans and advances) granted by Yemeni commercial banks to the agricultural sector declined to 2 % during the study period. This percentage is small and indicates the weakness of the financing policy adopted by the commercial banks towards the agriculture and fish sector which is a source of some of the basic needs of the society in Yemen.The percentage increased from 2% to 5% during the period from 2011 to 2016.

This increase may lead people to agriculture as a result of the political crisis experienced by the country. The banks see a high risk of lending in this sector. It is reluctant to grant loans especially long term loans.

Development of the Industrial Sector

The relative importance of credit facilities to the industrial sector fluctuated from one year to the next. In generalThe table shows that the percentage decreased from 15% to 9% in the industrial sector during the period 2011 to 2016. The average during the study period was 15%. Commercial banks should therefore consider their financing policies in this sector.The average relative importance of credit facilities provided to the industrial sector was 15 % during study period.

Development of Construction and Structure Sector

Development of the Trade Sector

The trade sector accounted for more than half of the total banking credit facilities as a whole. The relative importance of facilities in this sector declined from 56% in 2011 to 46 % in 2014. The average during the study period was 50%. Most of these loans go to finance foreign trade and imports. This is evidence that Yemen is an importer of raw materials for the production process. Commercial banks which has a high profit rate and the ability to self-liquidation and requests payment within a special year of the current account

Development of the Services Sector

The share of the services sector in credit facilities is high on average 21% during the period of study and comes in second place after the trade sector, and it is noted that the average contribution of the ratio to facilities for this sector during the study period. Service facilities are still small and can not provide the guarantees and conditions required by banks when providing credit and we believe that this situation may be appropriate because this sector is service.

Classification of Direct Credit Facilities by Type of Bank

Table (5)Direct Credit Facilities by Type of Bank )Billion Riyals)

Item /year 2011 2012 2013 2014 2015 2016 Total Government Banks (1) 466.5 378.2 414.9 577.4 468.8 386.2 Total Domestic Traditional

Banks (2)

412.2 521.4 621.6 634.5 630.1 606.2

Total branches of foreign banks (3)

237.1 232.3 316.5 234.7 132.4 105.3

Total Islamic Banks (4) 642.3 617.8 1045.8 1026.1 652.7 500.6 Total Microfinance Banks (5) 2.9 7.5 19.1 24.6 15.7 13.2 Total credit 6)) 1761 1757.3 2418 2497.2 1899.7 1611.6 Ratio (1) \ (6) 26.5% 21.5% 17.2% 23.1% 24.7% 24.0% Ratio (2) \ (6) 23.4% 29.7% 25.7% 25.4% 33.2% 37.6% Ratio (3) \ (6) 13.5% 13.2% 13.1% 9.4% 7.0% 6.5% Ratio (4) \ (6) 36.5% 35.2% 43.3% 41.1% 34.4% 31.1% Ratio (5) \ (6) 0.2% 0.4% 0.8% 1.0% 0.8% 0.8% Total ratios 100% 100% 100% 100% 100% 100%

Average government banks 22.8%

Average local traditional banks 29.2%

Average foreign branches 10.4%

Average Islamic Banks 36.9%

Average Microfinance Banks 0.7%

In order to highlight the bank credit granted by the licensed banks in the Republic of Yemen during the period studied, Table () shows the facilities granted by licensed Islamic and conventional banks.The data of the previous table shows that the contribution of conventional banks to the granting of credit facilities reached 63.1 % during the period of study as it is considered low to total direct credit facilities. Islamic banks also received 36.9% of the total direct credit facilities. The traditional banks in the deposit of these facilities in the central bank in the form of treasury bills because of the high return, which reduced the orientation of those facilities to the private sector, where the government sector accounted for about 70 % of the total credit compared to 30 % of the private sector, Relative in the Islamic banks that it does not invest their money in deposit in the central bank in the form of treasury bills, which led to increase the proportion of the relative importance in the rate of Islamic banks and increase directing its funds to the private sector.

Conclusion

Credit facilities according to the time frame, where loans and short-term advances in commercial banks accounted for 81%. The medium-term loans amounted to 19%. We note the concentration of funds in short-term loans, mostly to finance trade operations in import and trade. Where Islamic banks accounted for 30% of the volume of direct credit facilities and these investments accounted for a high percentage of thetotal credit. This is due to commercial banks investing most of their deposits in the public sector in the form of treasury bills in the Central Bank of Yemen. We find that the rated loans increased significantly during the study period, reaching 18% in 2011 and then increased to 47% in 2016.This rise shows the size of the risks faced by banks and attributed this rise to the political crisis in Yemen.

The direct credit facilities granted by commercial banks were distributed by economic sectors during the period 2011-2016, where the average relative importance was as follows:

• Agriculture sector at 4% • Industry 14%

• Construction Sector 12% • Trade Sector 50% • Services Sector 21%

Direct credit facilities depending on the type of bank

Conventional banks are as follows

• Government banks accounted for 22.8% of direct credit facilities • Local conventional banks accounted for 29.2%

• Conventional banks accounted for 62.4%

• Islamic banks share of direct credit facilities reached 37.6%

References

1. Hampel. (1999). Bank Management - Text & Cases, 4 Ed, U.S.A. 2. Ashhab, Imad. (2008). Basel II Road Map in Arab Banks, P.134.

3. Hanafi, Abdul Ghaffar&Abuqaf, Abdul Salam. (1991). Modern Management- Commercial Banks, University Publishing House. Beirut, P.9.

4. Hempel, G. & Simonson, D. (1999). Bank Management - Text and Cases. 5th Ed. Hoboken, USA: John Wiley and Sons, Inc.

5. Abdel-Aal. (2001). Banking Performance Assessment, Risk and Return Analysis, University Publishing House. Alexandria, P.72.

6. Al-Alfi, Abdulaziz. (1997). Bank Credit and Credit Analysis, Industrial Development Bank of Egypt. Cairo,P.188.

7. Al-Shahat, Nadir Mohammed(2001). Financial Management, Mansoura Publishing, First Edition p. 495.