VALUE OF INTELLECTUAL CAPITAL ON CORPORATE PERFORMANCE:

Full text

Figure

Related documents

MapReduce, has been used by many projects to perform geospatial processing in the cloud or in cloud-like enterprise data centers.. Transaction oriented analytics: processing

The size complexity counts the number of continuous and binary variables as well as the number of constraints the model needs to formulate a problem with configurations,

(127) The government’s fiscal situation was good (close to balanced budget) when the innovation was created/abolished (manageable or no provincial debt). Strongly

Structured Products do not constitute participation in a collective investment scheme within the meaning of the Swiss Federal Act on Collective Investment Schemes (CISA) and are

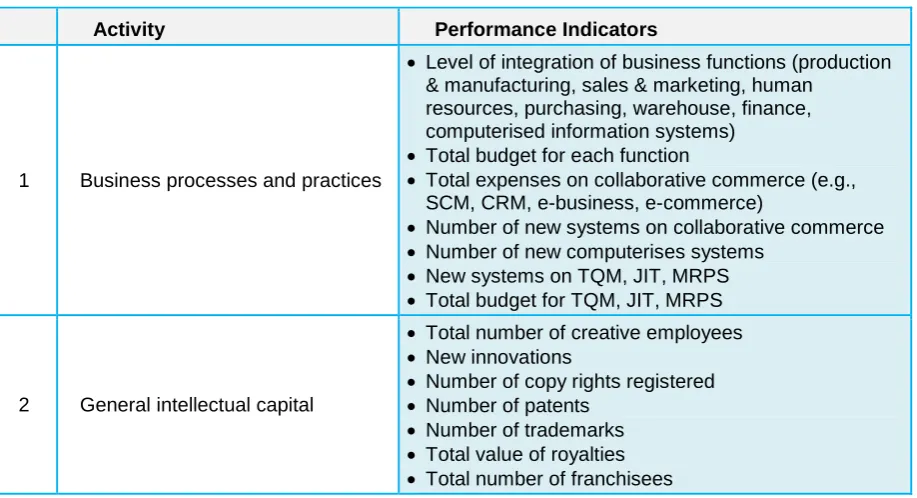

The aim of this paper is to present the current position of Bosnia and Herzegovina on its establishment of the knowledge based society through the application of the

PL5263005078 SPAIN Honda Motor Europe Logistics NV, Sucursal en España ESW0172688D ITALY Honda Motor Europe Logistics NV IT04210630234 UK Honda Motor Europe Logistics NV

i feel that the school is spending money on things that they don't have to and go to other things like extracurricular activities or better learning for students.. We already had

We discuss a method for performing depth first search and solving re- lated problems efficiently in external memory and how it can be used, in conjunction