Incisional Negative Pressure Wound Therapy in the Prevention of Surgical Site Infection after Vascular Surgery with Inguinal Incisions: Rationale and Design of a Randomized Controlled Trial (INVIPS Trial)

Full text

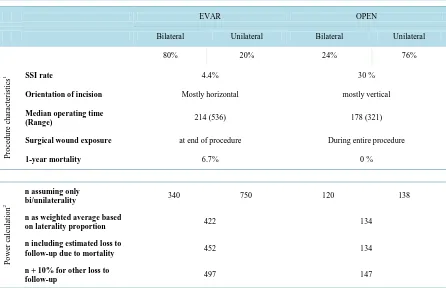

Figure

Related documents

practices and results of tuberculin skin test (TST) screen- ing of schoolchildren in the United

Indeed, the composite BG–GCL record documents co- herence, at both orbital and millennial scales, between Por- tuguese hydroclimate, vegetation, and Iberian margin SST during the

In view of this gap, the main purpose of this paper is to explore the dimensions of KM maturity in academic libraries namely top management support and

The results of this study show the existence of antioxidant activities with higher stability in storage time and the protective effect of arbutin and Pyrus

For the Bluetooth module, low cost Cytron Bluebee Bluetooth module is chosen to establish the Bluetooth connection between main control board and the GUIs.. 2 Main

Mohan Kumar: Formulation and Evaluation of taste masked oral Disintegrating tablet of cefixime based on cyclodextrin binary systems: A Review , 5(2):

Unlike total folic acid activity, as assayed with L. casei, which is lower in the blood of infants than in adults, the metabolically active folinic acid group of compounds,

Tax Credit: Unlike deductions which are subtracted from your income, credits are subtracted directly from the amount of taxes owed. Credits exist for dependent children, child