Project Evaluation

CHAPTER

Project Evaluation

CHAPTER

3

Objectives

• Explain how individual projects can be grouped into programs;

• Explain how the implementation of programs and projects can be managed so that the planned benefits are achieved;

• Carry out an evaluation and selection of projects against strategic, technical and economic criteria;

• Use a variety of cost-benefit evaluation techniques for choosing among • Use a variety of cost-benefit evaluation techniques for choosing among

completing project proposals;

Project Evaluation

Select Project 0 23.1 Introduction

Identify project scope and objective1 Identify project

infrastructure 2 Analyze project characteristics 3 Identify the products and activities

4 Estimate effort for activity 5 Identify activity risks

6 For each activity

Lower level detail Review

Allocate resources

7

Lower level planning

10

Project Evaluation

3.2 Program Management

Program Management

“A group of projects that are managed in a coordinated way to gain benefit that would not be possible were the projects to be managed independently” (D.C. Ferns)

Program Management is a collection of projects that all contribute to the same overall organizational goals. Effective program management requires that there is a well-defined program goal and that all the organization’s projects are selected program goal and that all the organization’s projects are selected and tuned to contribute to this goal. A project must be evaluated

according to how it contributes to this program goal and its

Project Evaluation

3.2 Program Management

Program Management

Strategic program

Business cycle program Infrastructure program

Project Evaluation

3.3 Managing the allocation of resource within programs

Program Management

Program Manager Project Manager

Many simultaneous projects One project at a time

Personal relationship with skilled

resources Impersonal relationship withresource type

Need to maximize utilization of

resources Need to minimize demand forresources

resources resources

Projects tend to be similar Projects tend to be dissimilar

Project Evaluation

3.3 Managing the allocation of resource within programs

Project Evaluation

3.5 Creating a Program

Program Mandate

The new services or capabilities the program should deliver How the organization will be improved by use of the new

services or capability

How the program fits with corporate goals and any other

Project Evaluation

3.5 Creating a Program

Program Brief

A preliminary vision statement which describes the new

capacity that the organization seeks – it is described as ‘preliminary’ because this will later be elaborated

The benefits that the program should create Risks and Issues

Project Evaluation

3.5 Creating a Program

The Vision Statement

Program manager who would have day-to-day responsibility

for running program could well be appointed. The program manager is likely to be someone with considerable project management experience

This group can now take the vision statement outlined in the

Project Evaluation

3.5 Creating a Program

Blueprint

Business models outlining the new processes required Organizational structure

The information systems, equipment and other, non-staff,

resources that will be needed

Data and information requirements

Project Evaluation

3.5 Creating a Program

Blueprint –

Preliminary plan can be produced containing: The project portfolio

Cost estimates for each project The benefits expected

Risks identified

The resources needed to manage, support and monitor the The resources needed to manage, support and monitor the

Project Evaluation

3.6 Aids to program management

Dependency diagrams

Project Evaluation

3.6 Aids to program management

Dependency diagrams (Example)

B Corporate image design

A System

study/design C Build commonsystems F Data migration

G Implement corporate interface

Project Evaluation

3.6 Aids to program management

Delivery Planning

The creation of a delivery dependency diagram would

typically be a precursor to more detailed program planning. As part of this planning, tranches of project could be defined.

A tranche is a group of projects that will deliver their products

Project Evaluation

3.6 Aids to program management

Delivery Planning

Project A

Project C

Project D

Project B

Project D

Project E

Project Evaluation

3.7 Benefits Management

Benefit Management is an attempt to remedy this. It encompasses the identification, optimization and tracking of the expected benefits from a business change in order to ensure that expected benefits from a business change in order to ensure that they are actually achieved.

• Defined the expected benefits from the program

• Analyze the balance between costs and benefits

• Plan how the benefits will be achieved and measured

• Allocate responsibilities for the successful delivery of the benefits

• Allocate responsibilities for the successful delivery of the benefits

Project Evaluation

3.7 Benefits Management

Benefits can be of many different types, including:

Mandatory compliance

Mandatory compliance

Quality of service

Productivity

More motivated workforce

Internal management benefits

Risk reduction

Economy

Revenue enhancement/acceleration

Project Evaluation

3.7 Benefits Management

Quantifying benefits

Quantified and valued

Quantified and valued

Quantified but not valued

Project Evaluation

Project Evaluation

Overview of Feasibility

• A systems request must pass several

tests, called a

feasibility study

, to see

tests, called a

feasibility study

, to see

Project Evaluation

•

Economic Feasibility

–

Total cost of ownership (TCO)

Overview of Feasibility

–

Total cost of ownership (TCO)

– Tangible benefits

– Intangible benefits

– Tangible Costs

Project Evaluation

•

Economic Feasibility

Overview of Feasibility

Cost-benefit Analysis

Cost-benefit Analysis

Net Profit

Payback Period

Return on Investment

Net Present Value

Project Evaluation

•

Technical Feasibility

–

Technical feasibility

refers to technical

resources needed to develop, purchase,

Overview of Feasibility

resources needed to develop, purchase,

install, or operate the system

• New Technology

• Existing Technology

Project Evaluation

Overview of Feasibility

•

Operational Feasibility

–

Operational feasibility

means that a

proposed system will be used effectively

proposed system will be used effectively

after it has been developed

• Performance

• Information

• Economy

• Control

• Efficiency

• Efficiency

Project Evaluation

3.8 Evaluation of individual projects

Three major factors will need to be considered in the evaluation of potential projects:

evaluation of potential projects:

Technical feasibility

The balance of costs and benefits

Project Evaluation

3.9 Technical assessment

• Evaluating the required functionality against the hardware • Evaluating the required functionality against the hardware

and software available. • The Constraints

Project Evaluation

3.4 Cost-benefit Analysis

The standard way of evaluating the economic benefits of any project is to carry out a cost-benefit analysis, which consists of two steps:

Identifying and estimating all of the costs and benefits of carrying out the project and operating the system.

Project Evaluation

3.4 Cost-benefit Analysis

Most direct costs are easy to identify and measure in monetary terms.

Development costs

Setup costs

Project Evaluation

3.10 Cost-benefit Analysis

Benefits may be categorized as follows:

Direct benefits

Assessable indirect benefits

Intangible benefits

Project Evaluation

3.11 Cash flow forecasting

In c o m e In c o m e E x p e n d it u re Time

Typical product life cycle cash flow

Project Evaluation

3.11 Cash flow forecasting

Year Project 1 Project 2 Project 3 Project 4

0 -100,000 -1,000,000 -100,000 -120,000 0 -100,000 -1,000,000 -100,000 -120,000 1 10,000 200,000 30,000 30,000 2 10,000 200,000 30,000 30,000 3 10,000 200,000 30,000 30,000 4 20,000 200,000 30,000 30,000 5 100,000 300,000 30,000 75,000

Project Evaluation

3.12 Cost-benefit evaluation techniques

How to calculate Net Profit?

Net Profit

= Total income

–

Total cost

Project 1 Project 2 Project 3 Project 4

Project Evaluation

3.12 Cost-benefit evaluation techniques

How to calculate Payback Period?

Payback Period

Is the time taken to break even or pay back the initial investment.

0 1 2 -100,000 10,000 10,000 -100,000 -90,000 -80,000 Year Cash Flow Payback Period

Project 1 2

Project Evaluation

3.12 Cost-benefit evaluation techniques

Return on Investment

The return on investment (ROI) also known as the accounting rate of The return on investment (ROI) also known as the accounting rate of return (ARR), provides a way of comparing the net profitability to the investment required.

100

investment

total

profit

annual

Project Evaluation

3.12 Cost-benefit evaluation techniques

Net Present Value (NPV)

NPV is a project evaluation technique that takes into

NPV is a project evaluation technique that takes into account the profitability of a project and the timing of the cash flows that are produced. It does so by discounting future cash flows by a percentage known as the discount rate. This is based on the view that receiving $100 today is better than having to wait until next year to receive it, because the $100 next year is worth less than $100 now.

tProject Evaluation

3.12 Cost-benefit evaluation techniques

Table 3.4: Applying the discount factors to project 1

Cash flow Discount factor Discount cash flow

Year Cash flow Discount factor Discount cash flow

(10%)

-100,000 1.0000 -100,000

10,000 0.9091 9,091

10,000 0.8264 8,264

10,000 0.7513 7,513

20,000 0.6830 13,660

100,000 0.6209 62,090

Year 0 1 2 3 4 5

50,000 NPV: 618

Project Evaluation

3.12 Cost-benefit evaluation techniques

Internal rate of return

IRR attemps to provide a profitability measure as a percentage return IRR attemps to provide a profitability measure as a percentage return that is directly comparable with interest rates. It is a convenient and useful

measure of the value of a project in that it is a single percentage figure that may be directly compared with rates of return on other projects or interest rates

quoted elsewhere.

8,000

8 10 12

0

Project Evaluation

3.12 Cost-benefit evaluation techniques

• A total evaluation must also take into account the problems of funding the cash flows.

• While a project’s IRR might indicate a profitable project, future earnings from a project might be far less reliable than

earnings from, say, investing with a bank.

Project Evaluation

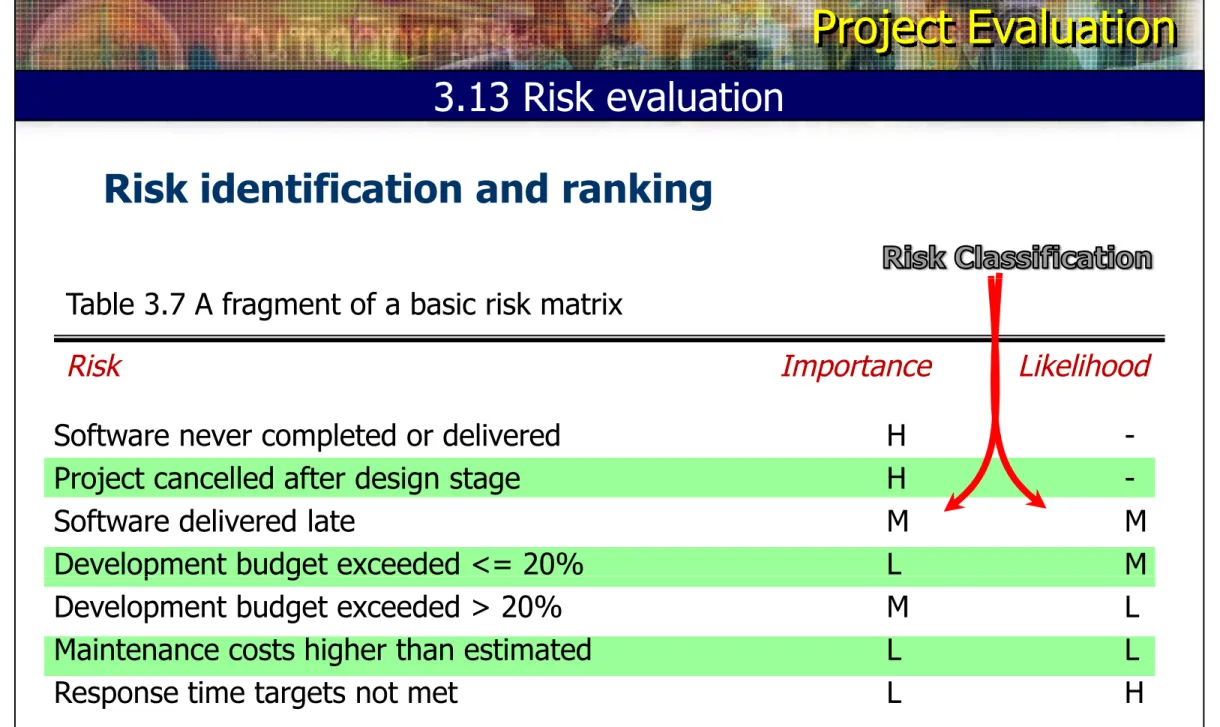

3.13 Risk evaluation

Risk identification and ranking

• Construct a project risk matrix utilizing a checklist of possible risks and

• Construct a project risk matrix utilizing a checklist of possible risks and

to classify each risk according to its relative importance and likelihood.

• Risk classification:

High (H)

Medium (M)

Low (L)

exceedingly unlikely (-)

Project Evaluation

3.13 Risk evaluation

Risk identification and ranking

Table 3.7 A fragment of a basic risk matrix

Risk Importance Likelihood

Software never completed or delivered H

-Project cancelled after design stage H

-Software delivered late M M

Development budget exceeded <= 20% L M

Development budget exceeded <= 20% L M

Development budget exceeded > 20% M L

Project Evaluation

3.13 Risk evaluation

Risk and net present value

• Where a project is relatively risky it is common practice to use a • Where a project is relatively risky it is common practice to use a

higher discount rate to calculate NPV.

Project Evaluation

3.13 Risk evaluation

Cost-benefit analysis

• Evaluation of risk is to consider:

• Evaluation of risk is to consider:

• each possible outcome

• estimate the probability of its occurring and corresponding value of

Project Evaluation

3.13 Risk evaluation

Example 3.7:

Buyright, a software house, is considering developing a payroll application for use Buyright, a software house, is considering developing a payroll application for use academic institutions and is currently engaged in a cost-benefit analysis. Study of the market has shown that, if they can target it efficiently and no competing product become available, they will obtain a high level of sales generating an annual income $800,000. They estimate that there is 1 in 10 chance of this happening. However competitor might launch a competing application before their own launch date and then sales might generate only $100,000 per year. They estimate that there is a 30% chance of this happen. The most likely outcome, they believe, is somewhere between these two extremes – they will gain market lead by launching before any competing product become available and achieve an annual income of $650,000. Calculate the expected income?

income?

Project Evaluation

3.13 Risk evaluation

Risk profile analysis

• Involve varying each of the parameters that affect the project’s • Involve varying each of the parameters that affect the project’s

cost or benefits to ascertain how sensitive the project’s profitability is to each factor

• Sensitivity analysis

• Monte Carlo simulation

Project B Project C

Project Evaluation

3.13 Risk evaluation

Using decision trees

Expansion

NPV

-100,000

0.2

D

Extend

Replace

No expansion

Expansion

75,000

250,000

0.2 0.8

0.2

No expansion -50,000

Project Evaluation

3.13 Risk evaluation

Questions Amenda’s decision tree is selecting the extend or replace machines.

Project Evaluation

3.14 Conclusion

Projects must be evaluated on strategic, technical and economic grounds

Economic assessment involves the identification of all costs and income over the Economic assessment involves the identification of all costs and income over the

lifetime of the system, including its development and operation and checking that the total value of benefits exceeds total expenditure

Money received in the future is worth less than the same amount of money in

hand now, which may be invested to earn interest

The uncertainty surrounding estimates of future returns lowers their real value

measured now

Discounted cash flow techniques may be used to evaluate the present value of future cash flows taking account of interest rates and uncertainty