The American International Group

Principal – Agent Relationships

in the Financial Crisis in 2008

Authors

Preface

The topic of the work deals with the consequences of the principal-agent relationships in the financial crisis of the year 2008, particularly the ones of relationships of AIG. The following questions are: What kind of relationships are there? Which characteristics do these relations have? Which possible solutions are there to defuse the problems in these relationships? This scientific work is done in the context of the module Business Science. The module is part of the Master of Science of Business Information Systems studies of the University of Applied Sciences Northwestern Switzerland (www.fhnw.ch/msc-bis). The work was carried out as teamwork. For the co-ordination of the group the service "Google Sites" was used (sites.google.com/site/bsrgwaig).

We would like to thank all persons and organizations who have made a contribution for this work. We thank the authors for their engagement at the search for literature and writing the content. We also thank the company Google for providing the services which has made a smooth cooperation possible.

Olten in December 2008

Executive Summary

The American International Group, Inc. (AIG) is a world leader in insurance and financial ser-vices. It is an international insurance organization with operations in more than 130 countries (AIG 2008c).

The principal agent problem is a theory concerning the relationship between a principal and an agent of the principal, which have asymmetric interest and information. The principal agent problem can be classified in three big categories: moral hazard, hold up and adverse selection.

The principal agent problem at the AIG and its consequences led close to the collapse of the AIG. In February 2008 Joseph Cassano, the leader of the Financial Products unit was fired and one month later the chief executive officer Martin Sullivan was also signed off from AIG. When AIG´s credit ratings were downgraded in September 2008 and the need for more money on hand increased beyond what it could borrow, AIG asked the Federal Reserve (FED) for help.

The following work shows different principal agent relationship problems in AIG, which are all related to each other (see chapter 4). The facts show that the principal agent problems are possibly responsible for the almost collapse in AIG during the financial crisis in 2008. The analyses show that there are certain facts, which point out the principal agent problems in AIG but there is no final proof.

Table of Contents

Preface ...I Executive Summary...II Table of Contents ...III List of Figures and Tables ... V List of Abbreviations ... VI

1 The American International Group ...1

1.1 History ...1

1.2 Products ...1

1.3 Vision & Values ...2

1.4 Corporate Governance...2

2 AIG and the Current Financial Crisis ...3

2.1 Chain of events leading to the call for help at the FED ...3

2.2 Situation at the Stock Exchange ...5

2.3 Income Situation ...6

3 Related Theory and Research Approach ...8

3.1 Related Theory for the Principal – Agent Relationships at the AIG ...8

3.2 Research Approach ...9

3.2.1 Research Question...9

3.2.2 Hypothesis...9

3.2.3 Specific Aim...10

4 Principal – Agent Relationships...11

4.1 Relationship “CDS and CDO Customers (Banks) – AIG Financial Products“ ...12

4.1.1 Characteristics of the Relationships ...13

4.1.2 Problematic Nature of the Relationships ...14

4.1.3 Solutions to Improve the Relationship ...15

4.1.4 Conclusion...16

4.2 Relationship “AIG Holding – AIG Financial Products“ ...16

4.2.1 Objectives and interests of AIG Financial Products Corp. (AIG FP) ...17

4.2.2 Objectives and interests of American International Group, Inc. ...17

4.2.4 How can these principal agent problems are prevented in the future ...19

4.2.5 Conclusion...19

4.3 Relationship “AIG Financial Products – Rating Agencies“ ...19

4.3.1 Characteristics of the Relationships ...20

4.3.2 Problematic Nature of the Relationships ...21

4.3.3 Solutions to Improve the Relationship ...22

4.3.4 Conclusion...23

4.4 Relationship “AIG Financial Products (Joseph J. Cassano) – Consultant (Gary Gorton)”...23

4.4.1 Goals and Measures ...24

4.4.2 Problematic Nature of the Relationship ...25

4.4.3 Solutions to Improve the Relationship ...26

4.4.4 Conclusion...29

5 Overall Conclusion ...31

List of Figures and Tables

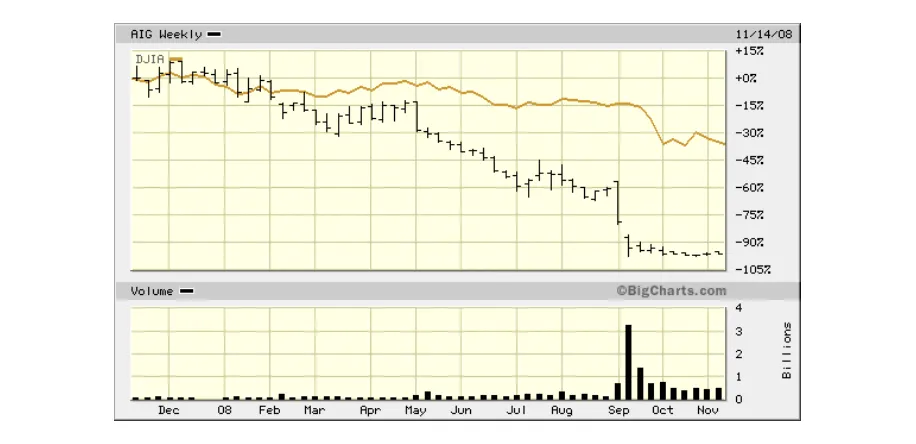

Figure 2-1: AIG Situation: A tiny unit at American International Group... (The New York Times 2008a) ...3 Figure 2-2: AIG Situation: ...was well compensated for generating a significant share of

revenue... (The New York Times 2008a) ...4 Figure 2-3: AIG Situation: ... from selling contracts that protected clients from losses on

debt (The New York Times 2008a) ...4 Figure 2-4: AIG Situation: Punished by rating agencies into a downward spiral (The

New York Times 2008) ...5 Figure 2-5: AIG (Common Stock) Chart from November 15, 2007 to November 14,

2008 compared to the DowJones Index (BigCharts 2008) ...5 Figure 2-6: Overview on the quarterly income since 2003 (The New York Times,

2008c) ...7 Figure 4-1: Examined Principal – Agent Relationships in an Overview ...11 Figure 4-2: Major event between insurance customers the AIG (Mollenkamp et al.,

2008)...13 Figure 4-3: Notional Amounts Outstanding CDS, Semiannual Data 2001 -2008 (ISDA

2008)...15

List of Abbreviations

AIG American International Group, Inc. AIG FP AIG Financial Products

CDO Collateralized Debt Obligation CDS Credit-Default Swaps

FED Federal Reserve Bank of the United States America IOSCO International Organization of Securities Commissions SEC Securities and Exchange Commission

1

The American International Group

The American International Group, Inc. (AIG) is a world leader in insurance and financial ser-vices. It is an international insurance organization with operations in more than 130 countries (AIG 2008c).

The AIG holding companies serve commercial, institutional and individual customers through a worldwide property-casualty and life insurance networks of any insurer. AIG companies are providers of retirement services, financial services and asset management.

AIG's common stock is listed at the New York Stock Exchange and at the stock exchanges in Ireland and Tokyo.

1.1 History

According to the American International Group, Inc. (AIG 2008d), the company history of AIG started in 1919, when Cornelius Vander Starr founded an insurance agency named Ameri-can Asiatic Underwriters in Shanghai, followed by decades of expansion. Despite some diffi-culties in wartimes, Vander Starr established several companies like Asia Life Insurance Company, American International Underwriters, The Philippine American Life and General Insurance Company and American International Assurance Company, Ltd, represented in about 75 countries by the end of the 1960s. The firm American International Group, Inc. (AIG) was formed in 1967 and went public two years later with Maurice R. Greenberg as President and CEO.

Greenberg "was the chairman of the American International Group from 1968 to 2005, during which time he built the small insurance company into what became the world’s largest insur-ance and financial services corporation" (The New York Times 2008b).

Considering the context of today’s financial crisis and AIG's tarnished position, a very impor-tant step in AIG's history may be what AIG entitles with "Expanding into Financial Services" (AIG 2008d): In 1987, AIG Financial Products Corp. was formed in 1987 to specialize in com-plex derivative product transactions later followed by other AIG company foundations includ-ing leasinclud-ing, bankinclud-ing and real estate.

Concerning the company leadership, the past years brought more changes than the previous decades: Greenberg "was succeeded by Martin J. Sullivan and President and CEO…" who "… resigned from AIG in 2008, and was succeeded as CEO by Robert B. Willumstad.…” Mr. Willumstad now holds both the CEO and Chairman positions" (AIG 2008d).

1.2 Products

AIG offers product in four principal business segments (AIG 2008c):

• Life Insurance & Retirement Services: AIG has the most extensive global network of any life insurer, a leading U.S. life insurance organization and a premier retirement services franchise with a leadership position in the U.S. fixed annuities market as well as a grow-ing international network.

• Financial Services: AIG has a major presence in aircraft finance, capital markets, con-sumer finance and insurance premium finance.

• Asset Management: AIG provides institutional and individual assets, retail funds and pri-vate banking through a growing global network.

1.3 Vision & Values

The vision which AIG has given itself: “To be the world’s first choice provider of insurance and financial services. We will create unmatched value for our customers, colleagues, busi-ness partners, and shareholders, as we contribute to the growth of sustainable, prosperous communities.” (AIG 2008b)

The value which AIG has given itself: “Our mission at AIG is to provide our customers all over the world with exceptional products and exemplary service; however, this goal can only be realized if we are consistently guided by our shared beliefs - our values.” (AIG 2008b)

1.4 Corporate Governance

The AIG’s board of directors has established the AIG Corporate Governance Guidelines to promote the effective functioning of the Board and its committees, to promote the interests of shareholders and to establish a common set of expectations for the governance of the or-ganization (AIG 2008a).

The Corporate Governance Guidelines contain:

• Director Independence Standards

• Charters of Audit

• Compensation and Management Resources

• Finance

• Nominating and Corporate Governance

• Public Policy and Social Responsibility

• Regulatory, Compliance and Legal Committees

• Director, Executive Officer and Senior Financial Officer Code of Business Conduct and Ethics

2

AIG and the Current Financial Crisis

Today, AIG is in a very uncomfortable situation due to the current financial crisis. Being the chain of events represented briefly in the following includes how it has come to the call for help at the FED. Furthermore how the AIG share has developed at the stock exchange and a look at its income in the recent years.

2.1 Chain of events leading to the call for help at the FED

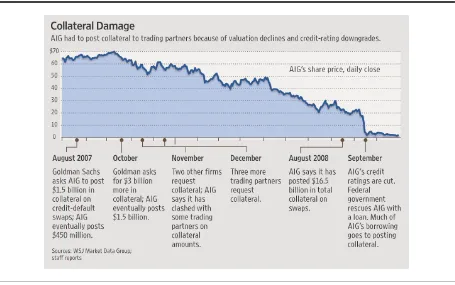

The New York Times (2008a) has the opinion that a tiny unit at American International Group brought the giant to the edge of bankruptcy: The London unit AIG Financial Products which sold complex financial contracts called credit derivatives. The following context turns out from dozens of interviews, from internal documents and testimonies before the U.S. congress. It was all about Credit default Swaps (CDS) (Wikipedia 2008c) and Collateralized Debt Obli-gation (CDO) (Wikipedia 2008d), a sort of insurance against payment losses. Over years AIG sold insurances for losses on debt in the value of many billions of dollars. All possible loans hid themselves behind these disastrous CDS and CDO: Company loan, second-class build-ing loans (subprime) and credit card liabilities. The customers of these "swaps" hedged against payment losses for which AIG had to stand in.

The customers of the CDS and CDO normally have the right to ask for securities from AIG if the insured debt loses value or the rating of AIG worsens. Moreover, AIG must then write off the CDS and CDO in its own books. AIG insured immense credit sums to 2007 without pro-tecting itself adequately. Eight to nine billion dollars hedged for example Goldman Sachs from AIG and therefore almost completely covered its own risk.

The New York Times illustrated what happened that brought AIG in this difficult situation to-day, with a short sequence of text and charts.

Those derivatives had been a big source of revenue for AIG which paid the roughly 400 peo-ple in that Financial Products unit an average of more than $1 million a year.

Compensation: Revenues:

Figure 2-2: AIG Situation: ...was well compensated for generating a significant share of reve-nue... (The New York Times 2008a)

The Financial Products unit generated these revenues from selling contracts that protected clients from losses on debt. They insured $513 billion of debt against default using Credit-Default Swaps (CDS). $78 billion worth of insured debt was affected by the decline in the U.S. housing market. But as certain debt losses increased, AIG was forced to enlarge its own financial reserves and lower the value of some of its own holdings. Ratings agencies pun-ished the company, ultimately forcing it into a downward spiral.

Figure 2-3: AIG Situation: ... from selling contracts that protected clients from losses on debt (The New York Times 2008a)

down-graded September 15 2008, the need for more liquid money increased beyond what it could borrow and AIG asked the Federal Reserve for help.

Figure 2-4: AIG Situation: Punished by rating agencies into a downward spiral (The New York Times 2008)

2.2 Situation at the Stock Exchange

As capital concerns and potential mortgage-related losses continue to bother AIG the share prices drop substantially. During the peaks of the crisis nervous investors continued to sell their shares and hammered AIG stocks. The behavior of rating agencies and customers could also begin to punish the company.

Shares in AIG fell more than 60 percent on Monday, September 15 2008 and the company’s potential write-offs were mounting and reached 60 to 70 billion dollars.

There is a basic pattern: the lower the stock price, the harder it can be for the firm to raise capital. The lower the capital the bigger the concerns, and so on. If this goes on for a while the firm finds itself close to bankruptcy and there is no other possibility than governmental help. This is exactly what happened to AIG.

What we can see from table 2.1 is how fast the drop in the share price happened: AIG’s shares dropped by 95% within one year.

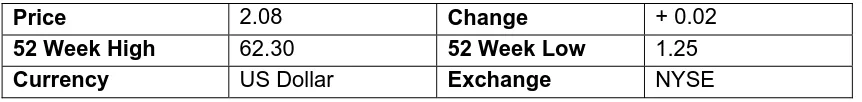

Table 2-1: AIG (Common Stock) November 14, 2008 (BigCharts 2008)

Price 2.08 Change + 0.02

52 Week High 62.30 52 Week Low 1.25

Currency US Dollar Exchange NYSE

2.3 Income Situation

The consolidated financial results are structured according to the main operating segments which are described in chapter 1.2. The following chart shows the development of AIG's fi-nancial results in the past five years. In particular the disproportional losses are conspicuous. Whilst the losses of other units (life insurance or asset management) are in the range of their profits in previous years, the financial services segment shows enormous losses since the last quarter of 2007. Concretely financial services accounted a loss of 10'523 million dollars in the fourth quarter of 2007 (Hamrah & Winans 2007). The financial report of 2007 (AIG 2007) declares a loss of $ 9'515 million, noting, that this "includes an unrealized market valuation loss of $11.5 billion on AIG FP’s super senior credit default swap portfolio". What is not shown in Figure 2-6: In the third quarter of 2008, actually the unit general insur-ance had a loss of $2,5 billion, life insurinsur-ances even $15,3 billion and financial services $ 8,2 billion leading to a total net income of $ -37,6 billion for the first 9 month of this year (Hamrah & Ashooh 2008).

3

Related Theory and Research Approach

In this chapter the theory used about principal – agent relationships and the research ap-proach are explained. Theory and apap-proach are valid for all examined relationships de-scribed in chapter 4.

3.1 Related Theory for the Principal – Agent Relationships at the AIG

In the following chapter we will comment on the theory regarding the principal – agent rela-tionship in AIG. A principal – agent model is mainly developed to formulate the asymmetry of information in knowledge sharing.

A principal – agent relationship has arisen between two or more parties when one, desig-nated as the agent, acts for, on behalf of, or as representative for the other, desigdesig-nated the principal, in a particular domain of decision problems. The agent is empowered to act for the principal because the principal chooses to hire the agent or because there is an implicit con-tract between principal and agent. The principal – agent problem lies in the fact that differ-ences of interest and information between the two parties mean that the agent may not al-ways act in the interests of the principal (Wikipedia 2008a).

The principle – agent problem describes the effect of the agent’s motivation or incentive in executing their task, and how it satisfies the desired objectives of a task. In mortgage lend-ing, the agents of the lenders functioned with their own compensation in mind: They origi-nated mortgages and helped people obtain mortgages, regardless of whether it seemed like they could afford it of if they were even being truthful in their application, as they were paid their fee by origination. They operated, as most everyone does, with their self-interest in mind.

Agency problems can be classified in three big categories (Duffner 2003): Moral Hazard de-scribes situations, in which the agent uses information not observable by the principal which is then called hidden information or performs actions not observable by the principal (hidden action) in order to increase his own utility against the principal’s best interest.

The second category hold up describes situations in which the agent systematically uses gaps in incomplete contracts, in which not every future state is specified, in his favor after signing the contract and after specific investments have been made and sunk costs have been incurred at the principal. The agent reveals his previously hidden intentions openly in-terpreting the fulfillment of his commitments in his favor and forcing the principal into renego-tiations.

The principal – agent problem plays a key role in the current financial crisis also called the subprime mortgage crisis. The global financial crisis really started to show its effects in the middle of 2008. Around the world stock markets have fallen, large financial institutions have collapsed or been bought, and governments in even the wealthiest nations have had to come up with rescue packages to bail out their financial systems.

While explaining the cause of this crisis seems complicated to even the best of minds, ex-cessive investment in instruments like credit default swaps that insured the debt of other in-stitutions seems to be a likely cause for bankruptcies. Once the housing bubble bursted a lot of companies were sent down.

To a large extent the troubles that have claimed AIG are not so much a financial crisis as an ownership crisis. It is not markets that have failed, but a peculiar form of ownership that we have taken for granted for decades - stock market-listed companies with dispersed share-holders. So, one form of ownership has caused a crisis, and another hasn't. The reason for this lies in the principal-agent problem.

3.2 Research Approach

The research approach includes the research question, the hypothesis derived from it and the specific aim on which one has worked towards for results.

3.2.1 Research Question

As it is represented chapters above in detail, there were some events at the AIG which indi-cate the existence of hidden information in principal – agent relationships. Hidden information often is the reason that risks are not recognized correctly or assessed wrongly. Or that den information is used of one party for the better of one's own. It also can happen that hid-den information is not analyzed at all since two parties trust themselves very strongly. The examination question therefore is:

• Were too high risk aversion, moral hazard and blind confidence responsible for the fi-nancial crisis of AIG and how is it possible to prevent these situations in their princi-pal-agent relationship in the future?

3.2.2 Hypothesis

From the research question the hypothesis can directly be derived. The parties in the princi-pal – agent relationships must be stirred up that they have less hidden information and are willing on a common objective regarding reduction of risks. The hypotheses therefore are:

• The risk of hidden information must be shared up equally between principal and agent. One result from the spread of the risk will be less moral hazard.

3.2.3 Specific Aim

With pursuing of the specific aim the hypotheses made has to be proved. In the chapter 4 are four specific principal – agent relationships situations of the AIG explained. On these rela-tionships it is shown that the claims made can be fulfilled. The specific aim therefore is:

4

Principal – Agent Relationships

There are many principal – agent relationships in and around an enterprise like AIG. During this work approximately 10 different relationships which could have a certain meaning in the current financial crisis were identified by the authors. In the opinion of the authors the four principal – agent relationships described in the following chapters are the ones which can most strongly be connected to the crisis.

Figure 4-1 shows the four examined relationships in an overview. The relationship between the AIG Holding and AIG Financial Products is an internal one (colored blue). The others are between AIG and an external organization (colored differently).

Rating Agencies Consultant (Gary Gorton)

Principal

Agent

Principal

Agent

AIG Financial Products (Joseph J. Cassano)

Principal

Agent

AIG Holding

Principal

Agent

CDS and CDO Customers (Banks)

Figure 4-1: Examined Principal – Agent Relationships in an Overview

Each of the examined relationships was processed by one of the four authors. Table 4-1: Examined Principal – Agent Relationships

Principal Agent Processed by

CDS and CDO Customers (Banks) AIG Financial Products Michael Quade

AIG Holding AIG Financial Products

(Joseph J. Cassano)

Stefanie Huthmacher

AIG Financial Products Rating Agencies Simon Lutz AIG Financial Products

(Joseph J. Cassano)

Consultant (Gary Gorton)

4.1 Relationship “CDS and CDO Customers (Banks) – AIG Financial Products“

As described in the chapter 1, the AIG is primarily an insurance company. The AIG offers next to common and ordinary insurance products like accident or life assurances very special insurance products too. Such special products are for banks. They insure their credits

against losses: These products are called financial products but these are actually insur-ances. The names of these products are “Credit Default Swaps” (CDS) (Wikipedia 2008c) and “Collateralized Debt Obligations” (CDO) (Wikipedia 2008d).

In principle, this one is the relationship between a policyholder and an insurance supplier. But this insurance business is special then it is about gigantic sums of money and there are only a few customers. In this relation the principal are the CDS and CDO customers (banks) and the agent is the AIG Financial Products (AIG FP) division.

This perception of the relation coincides with the theory, where the ordering customer is the principal which pays money to the agent, that this one delivers a given performance (Wikipedia 2008a). The customer pays a premium and expects of the insur-ance company that this renders the payments promised by contract in the event of loss. The main problem in this respect is that it has come just to the worst case of an event of loss.

AIG Financial Products

Principal

Agent

CDS and CDO Customers (Banks)

But fist a short introduction what happened between the banks and the AIG FP: AIG FP started with the CDS sale in 1998 (Mollenkamp et al., 2008) The head of AIG FP, Joseph J. Cassano, then was convinced based on Gary Gorton models (see chapter 4.4) that this business is a goldmine. With the calculation of this model the credit risks seemed extremely low. So AIG became largest supplier for CDS. The business was extremely lucrative over some years.

In 2004 the AIG FP group started to sell the protection against very complex Collateralized Debt Obligations (Pittman 2008). Only when the first difficulties emerged, on the mortgage market, doubts arose. AIG FP stopped the protection against complex CDO at the beginning of 2006. Though, AIG had already got a security coverage risk of 80 billion dollars there. Still in 2006 the insurer described the risk of having to pay for losses as highly improbable to the stock exchange supervision SEC (Morgenson 2006). AIG charged its customers the frac-tion of a penny for every insured dollar of a credit!

Middle of 2007 then the emerging of the worst case scenario (Weiss 2007): The rating agen-cies started to grade credit securitizations down (see also chapter 2.1 and 4.3). With the cus-tomer Goldman Sachs which was assured with AIG CDS in the volume of about 20 billion dollars, the nervousness increased (Morgenson 2008). Goldman demanded 1.5 billion dol-lars with the reference to the depreciation of the attested loans for securities in August 2007. AIG agreed on 450 million dollars. Goldman soon afterwards demanded another three billion. AIG shoved half of the sum after.

AIG reported the first greater depreciation in November 2007: 352 million dollars (AIG

board in those days, Sullivan (see chapter 1.1), still praised the risk models in his presenta-tion as "very reliable" (Morgenson 2008).

Figure 4-2: Major event between insurance customers the AIG (Mollenkamp et al., 2008)

However, the banks which had purchased CDS insurances of AIG demanded more and more securities (Pittman 2008): It was UBS, Barclays, Calyon and the Royal Bank of Scot-land by the end of 2007. The Deutsche Bank, CIBC and the Bank of Montreal also shall have required securities which the AIG does not have. This was the reason the AIG asked the FED for help. The AIG simply could not afford the payments they have to make because of the claims of the banks.

But now we want to get back to the actual principal – agent relationship now. In the following chapter the characteristics of the relationships are described.

4.1.1 Characteristics of the Relationships

The objectives of the principals (banks) are obvious: They wanted to insure themselves against a credit risk. The banks were porbably more conscious about the risks in their busi-ness than AIG FP. Risk aversion cannot be the only reason for the completion of the CDS business at the AIG. It rather makes the appearance that the offer of the AIG was simply for the banks so favorable that they had to purchase the CDS and CDOs. For a fraction of a penny per dollar, they were insured against the loss of a lot of capital. We also can assume that the AIG FP has advertised its product in the appropriate positions at the bank.

With the insurances everything went as long well as the credit market stably ran and the risk calculation model suited. Only when the first losses were declared, it went dramatically downhill. The insured banks got increasingly nervous when they noticed that the AIG cannot cover their possible losses. They insisted on the fulfillment of the insurance contracts very quickly.

Hidden information surely was to blame too for the debacle in this respect. The banks (prin-cipals) on the one hand didn’t know the model with which AIG FP calculated the premium for the banks and that the AIG FP cannot make the payments at all under its own steam in the worst case. The banks were probably not quite open on the other hand about the risks that the insured credits hide in themselves. The rating agencies are probably also not quite inno-cent about this fact (see also chapter 4.3).

Therefore hidden action has been the reason on both sides of the relationship that the situa-tion deteriorated so quickly. AIG FP has failed simply to take care that the insurance risks are spread. So the banks must not manage carefully their credits by the insurance at all. They have not recognized that there was simply no coverage from the insurance.

4.1.2 Problematic Nature of the Relationships

The problematic nature of this principal – agent relationship fits into the categories of moral hazard and adverse selection (see chapter 3.1).

Moral hazard was especially on the side of AIG FP because they underestimated risk and trusted an incomplete model. They saw only the business as a goldmine. But on the side of the bank there was moral hazard too. Because they were practically completely insured against loss, they could make relatively venturesome transactions with subprime mortgages. (Dr. Housing Bubble’s Blog, 2008)

However, what we also can say for certain that the model of Gorton distributed the risks very unequal. The AIG has to cover far too much risk by this model (see chapter 4.4). The banks have primarily profited from it. However, they even were not informed a long time about the fact that in the event of loss the AIG FP could get insolvent. The banks have paid for insur-ance but they had the risk of being left with their claims and losses.

-10'000.00 20'000.00 30'000.00 40'000.00 50'000.00 60'000.00 70'000.00

1H01 2H01 1H02 2H02 1H03 2H03 1H04 2H04 1H05 2H05 1H06 2H06 1H07 2H07 1H08 Billion Dollars

Figure 4-3: Notional Amounts Outstanding CDS, Semiannual Data 2001 -2008 (ISDA 2008)

However, what one cannot claim for certain that the AIG FP has not hedged. This is exactly the problems with the adverse selection now. AIG FP surely has insured only such credits against losses which were the banks are judged with AAA or AA by the rating agencies. AIG FP simply could not know that these ratings were downgraded suddenly and so drastically in the financial crisis. For what one can reproach AIP FP is that they only has relied on the rat-ings of the agencies which had judged the credits to be insured best (see chapter 4.3). The consequences of this adverse selection are that the market with CDS is after a continu-ous increase since 2001 now for the first time decreasing (Figure 4-3): From 62'173.20 billion Dollars in the second half of 2007 to 54'611.82 in the first half of 2008 (ISDA 2008).

4.1.3 Solutions to Improve the Relationship

The relation between the banks and AIG FP is in a disastrous state. But how can the relation between the AIG FP and the banks which want to have credits insured to be improved in fu-ture?

explicit contract). For normal insurances for private homes this is natural today (Dr. Housing Bubble’s Blog, 2008).

In future, the AIG FP try to uncover hidden information by taking into account not only as-sessments of rating agencies, which are well-intentioned to the credit business of banks. For the assessment of an insurance policy all rating agencies must be questioned.

The regulations also must be intensified by the state for the coverage of insurances: Only in-surances which can be covered by securities in the event of loss may be completed. The times for high boni payments at AIG Financial Products are for certain history. To fur-thermore be able to motivate the agent (employees at AIG FP), a new system of success measuring is needed. The success of the agent may not be measured with the regular profit any more with insurance premiums. Because this provokes a short-term positive way of thinking only, and this is not sustainable. Lastingly, it only can be when long-term success objectives are consulted for the boni.

The principal can for example stipulate an explicit insurance contract with the agent that is screened about the risk constantly. With the change of the risk the premium changes auto-matically. An when the principal does not suffer any loss with CDS for three years in conse-quence due to the automatic assessment by the agent, he gets a boni. The agent gets more critical and judges the CDS more carefully what for the two parties could results in a stable success in the long run (Sappington 1991 p. 52).

It will be a potential side effect of this measure that the business will be no longer so lucrative for the AIG FP. However, it has got anyway less lucrative by the financial crisis.

The proposed solution could work. But there is still too much greed in den financial sector and any precaution to make a business stable can be ineffective when nobody will play in this business any more. For sure a new business model will arise that looks like a goldmine and there will be a gold-rush like with the CDS. And what we learned from history, there will only be some very few which benefit from this rush, but the majority will loses. In this case the losers are the U.S. taxpayers and probably the taxpayers all over the world.

4.1.4 Conclusion

For the relationship “CDS and CDO Customers (Banks) – AIG Financial Products“ we can stipulate that the hypothesis and the objectives were confirmed. Acceptances were surely ta-ken and there are further uncertainties in our research. What is stipulated that by a better risk spread and by more explicit contracts in the event of loss, one surely would have been able to avoid some things. By regulations for establishing securities it would not have come to the call for help to the FED at all. AIG FP had simply hedged too little and loaded itself with too much risk on itself. The banks had well to take too little risk, superficially.

4.2 Relationship “AIG Holding – AIG Financial Products“

some-times come to different conclusions. Using this analysis, the principal agent theory is chosen to analyze the relationship between AIG Holding and its small unit AIG Financial Products.

This chapter applies principal-agent analysis to one such case, where the American International Group, Inc as a holding com-pany is taken as the principal and the agent is AIG Financial Products. American International Group, Inc. is a holding com-pany which, through its subsidiaries provides a varied range of insurance and insurance related activities in the United States and abroad. AIG Financial Products is a subsidiary of American International Group, based in London. The principal American In-ternational Group, Inc. is the shareholder of the company and elects the management in this case the management of the AIG Financial Products Corp., which is agent, to act on their behalf.

AIG Financial Products

(Joseph J. Cassano) Principal

Agent

AIG Holding

4.2.1 Objectives and interests of AIG Financial Products Corp. (AIG FP)

AIG Financial Products Corp. focuses its business on the over the counter derivatives mar-ket. AIG’s Financial Services businesses specialize in aircraft and equipment leasing, capital markets, consumer finance and insurance premium finance. These businesses complement AIG’s core insurance operations and achieve a competitive advantage by capitalizing on op-portunities throughout AIG’s global network.

AIG FP acts actually as a principal in nearly all of its transactions, providing clients and part-ners with a broad spectrum of capital markets offerings and tailored corporate finance, in-vestment and financial risk management solutions. In this chapter Financial Products Corp. is analyzed as an agent in the relationship with AIG, Inc, the holding company as the principal. AIG FP, managed by Joseph Cassano since 1988 until he was pushed out in early 2008, was a veritable money machine, pouring 6 billion dollar of riches into AIG's coffers from 1988 until 2005. The Financial Products unit sold credit-default swaps (CDS), contracts that plum-meted in value as the securities they guaranteed declined, causing more than 25 billion dol-lar in write downs. By the close of 2007, AIG held 562 billion doldol-lar risky and dangerous un-hedged credit default swap (CDS) contracts on its books. That amounted to more than half of all AIG's assets.

4.2.2 Objectives and interests of American International Group, Inc.

AIG’s Board of Directors has established the AIG Corporate Governance Guidelines to pro-mote the effective functioning of the Board and its committees, to propro-mote the interests of shareholders and to establish a common set of expectations for the governance of the or-ganization. These Guidelines were designed with AIG’s current business operations, owner-ship, capital structure, and economic conditions in mind.

The long time chief executive Hank Greenberg, who governed A.I.G., Inc with an iron hand and often battled openly with regulators, was removed by A.I.G.'s board March 2008.

4.2.3 Moral Hazard, Possible hidden information, hidden actions, adverse selection and their Consequences

Hidden information and hidden action in this case means that the agent Financial Product Corp. used information which was not observable by the AIG Holding. The American Interna-tional Group, Inc. was able to observe the final company outcome but it was obviously not able to observe the behavior of the Financial Product Corp. (agent), which means the behav-ior of Joseph Cassano. J. Cassano was not only the president of the Financial Product Corp., according to “The Times”, compensation ranged from 423 million dollar to 616 million dollar for Cassano's group. That would be about 20% of the unit's revenue, meaning J. Cassano was being paid like a hedge fund manager. The Financial Products Corp unit became profit-able enough that analysts considered J. Cassano as a candidate as chief executive of A.I.G. He was not controlled when he completed the Credit Default Swaps (CDS) of the subprime credit portfolio. Through this, AIG got deeply into the subprime mortgages during the last part of 2005 without realizing it. In 2006 AIG hid the level of CDS contracts in a tiny footnote, but did not include the figure in its table of derivatives, which were mostly interest rate swaps. In most cases AIG FP does not hedge its exposures related to credit default swaps it has written. That shows that AIG had a material weakness in its internal controls over financial reporting. By the close of 2007, AIG FP held 562 billion dollar risky and dangerous unhedged credit default swap contracts on its books. (AIG 2007) That amounted to more than half of all AIG's assets.

Another point was that incomes (loss) were charges of approximately 11.47 billion dollar ptax and 11.12 billion dollar preptax respectively, for a net unrealized market valuation loss re-lated to the AIG Financial Products Corp. super senior credit default swap portfolio. (AIG, 2007) Under the terms of these credit derivatives, losses to AIG would result from the credit impairment of any bonds AIG would acquire in satisfying its swap obligations. Based upon its most current analyses, AIG believes that any credit impairment losses realized over time by AIG FP will not be material to AIG’s consolidated financial condition, although it is possible that realized losses could be material to AIG’s consolidated results of operations for an indi-vidual reporting period. Except to the extent of any such realized credit impairment losses, AIG expects AIG FP’s unrealized market valuation losses to reverse over the remaining life of the super senior credit default swap portfolio.

would not have had the same information as the AIG FP. But the difference would be that J. Cassano did not hide any information for purpose.

The consequences of all these problems led to an almost huge collapse for AIG. In February 2008 J. Cassano was fired and one month later the long time chief executive Hank Green-berg was also signed off from AIG. When AIG´s credit ratings were downgraded in Septem-ber 2008 and the need for more money on hand increased beyond what it could borrow and AIG asked the Federal Reserve (FED) for help.

4.2.4 How can these principal agent problems are prevented in the future

It is known that a problem of moral hazard may arise when individuals like J. Cassano en-gage in risk sharing under conditions such that their personally taken actions affect the prob-ability distribution of the outcome. The principal Agent Relationship with the AIG and AIG Fi-nancial Products shows that more transparency, control and risk sharing would be a way to prevent those problems. The AIG Financial Product Corp. should have had also bear half of the risk and AIG should not have blindly confident in J. Cassano. The source of this moral hazard is an asymmetry of information among of AIG and AIG FP that results because the actions of especially AIG FP cannot be observed and hence contracted upon. AIG invested its resources into monitoring of actions of J. Cassano in earlier times and used this informa-tion in his contract.

On the other hand preventing these problems in the future is an important point. AIG already created the Corporate Governance Guidelines to establish a common set of expectations for the governance of the organization. But it seems it was not enough to lead a global corpora-tion like AIG successfully over years and in hard times like the financial crisis times.

4.2.5 Conclusion

If the principle and agent are really responsible for all the problems of AIG is not verifiable at all. There are just hints, which show that for example hidden information or adverse selection led to problems such as the Credit Default Swaps. However, at least a few public facts led assume us that the J. Cassano behaved in his own way. He earned 280 million dollar in cash, more than AIG chief executives, and for every dollar his financial products unit made, 30 cents came back to J. Cassano and his unit. But there is also no proof of these things, so we just can analyze the facts about what happened in the past and presume what they could have been done better or at least what they can do better in the future.

4.3 Relationship “AIG Financial Products – Rating Agencies“

so-called downgrade or an upgrade and can have big influence on the company. If the rating is downgraded, the cost of capital increases respectively the risk increases in case of insur-ance. To determine a rating statistical methods are used to calculate probabilities of failure. The factors which are used are quantitative, qualitative and based on experience. Rating agencies often base their ratings on data delivered by the investment bank. (Schweizer Fernsehen – ECO 2008)

During the last years, the market of the rating agencies grew substantially. During that time the rating agencies were not able to hire enough staff to cover the needs. That lead to a lot of work and high pressure – but the revenue grew steadily. That’s a very profitable business. Moody’s had for example revenues of 2.04 billion dollars and an income of 1.26 billion dol-lars. That’s an unbelievable operative return of 61.8%. The business segment for structured financing achieved 886.7 million dollars revenue. That is equal to 44.2% of the whole busi-ness (Moody’s Corporation 2006).

In the case of AIG banks sold assets with some bad risks hedged to their clients an insured the risk of a loss at AIG. To be able to determine the premium a rating was needed to see whether it’s a risky object or not. AIG or the investment bank pays for that rat-ing and relies on it – it’s somehow the seal of quality for the re-spective assets. Basically investment banks or insurances don’t request ratings of agencies that tend to give lower ratings – be-cause they can not sell assets without high rating. Therefore they only approach agencies that are willing to give high ratings. On the other hand the rating agencies are aware of that behavior and therefore tend to give too high ratings – a big temptation. Critical analysts have a hard time to prevail in such agencies and therefore leave them. That leads to the situation that only less critical analysts are left. The three big players are able to get more and more business and lose their critical analysts. That’s not too bad for their situa-tion. The rating agencies also don’t have enough competition since there are only three main players in a global market. (Schweizer Fernsehen – ECO 2008)

Rating Agencies

Principal

Agent

AIG Financial Products

In this relationship the principal is considered to be AIG – they want something and pay for it - and the rating agency acts as the agent – they receive money for their work.

4.3.1 Characteristics of the Relationships

The agent wants to be a market leader and have a lot of customers. Customers need to be satisfied and get what they want to have: good ratings – meaning that a high rating can be translated in a lot of money for the agent. The rating agency has basically no direct risk since they don’t participate in the assets the rate. The principal on the other hand has the same goals in its market: to grow and to be a leader. In order to achieve these goals they want to offer good products to their customers. In the financial market you can’t sell anything without a rating – that’s what the agent is hired for.

to 2006 (Schweizer Fernsehen – ECO 2008). This means that both, principal and agent sold a lot of business. The first measure – the development of the rated product – is delayed compared to the amount of ratings. But it is obvious that the development has not been posi-tive, it has caused a financial crisis. If the downgrade assets it directly leads to a drop of the stock exchange.

Hidden information also plays a big role in this relationship. There is no hidden information from the principal to the agent but the other way around. The agent did not inform the princi-pal at the right time about all the risks (always keep in mind that they sell more if they apply good ratings). An inquiry of the U.S. Securities and Exchange Commission which was con-ducted between August 2007 and July 2008 contains some interesting statements of em-ployees of the three big rating agencies, e.g. “We need to pray that we’re all rich and retired once this house of cards breaks down”.The same inquiry uncovers that ratings were give al-though some open questions were still not answered during the analysis – mostly due to re-source problems. (SEC 2008)

As an outcome of the above hidden information there was no action. We can define that as hidden action. There were a lot of warning signs during the last years and it is clear that rat-ing agencies did not react at all. They could have changed their ratrat-ings and adapt their ratrat-ing systems – but obviously they were more keen on selling than on minimizing the risk of the customers.

Furthermore, the House Oversight Committee of the US Congress held a hearing on the rat-ing agencies and released some material. There are exchanges like the followrat-ing, via instant message (Committee on Oversight and Government Reform, 2008):

“Thursday, April 05, 2007 3:58:42 pm EDT Shah, Rahul Dilip (Structured Finance - New Y-ork): btw that deal is ridiculous

Thursday, April 05, 2007 3:59:05 pm EDT Mooney, Shannon: i know right…model def does not capture half of the risk

Thursday, April 05, 2007 3:59:09 pm EDT Shah, Rahul Dilip (Structured Finance - New Y-ork): we should not be rating it

Thursday, April 05, 2007 3:59:17 pm EDT Mooney, Shannon: we rate every deal

Thursday, April 05, 2007 3:59:30 pm EDT Mooney, Shannon: it could be structured by cows and we would rate it

Thursday, April 05, 2007 3:59:54 pm EDT Shah, Rahul Dilip (Structured Finance - New Y-ork): but there’s a lot of risk associated with it - I personally don’t feel comfy signing off as a committee member”

4.3.2 Problematic Nature of the Relationships

The risk in this relationship is unequally spread: the principal has to cover all the risk and the agent has no risk. This of course leads to moral hazard. Anyway the principal itself could have come to the conclusion that some assets were too risky and not only rely on the agent. The agent certainly was aware of all facts. But since the agent has a totally different view it takes more time – or let’s say it needs more losses – until the agent reacts.

4.3.3 Solutions to Improve the Relationship

One of the main points is that the business model leads to some clear general problems: both participants of the rating process are interested in a good rating. The principal pays for the service and of course pays for a good rating. To overcome this problem a regulation au-thority would need to initiate the process for ratings. Basically we can state that overall more control of authorities is needed.

Another thing that needs to be verified is the code of conduct of the rating agencies is cor-rectly applied. It was issued by the International Organization of Securities Commissions (IOSCO) in December 2004 as a reaction on the Enron break-down. The code of conduct needs to be clearly specified since there above mentioned business model causes interest conflicts in this relationship. One of the points of the code of conduct is that the analysts shouldn’t have contact to the principal or even negotiate the price of the service (IOSCO 2004). The inquiry of the SEC proved this to not be the case. In the rating agencies it be-came clear that the analyst indirectly has a big influence on the market share of his cus-tomer. Was that share decreasing they were looking for a solution to improve the rating maybe by adapting the model on which it is based (SEC 2008). This increases the depend-ency on both sides: the principal needs the agent to improve the structuring of the assets (which structure leads to a better rating?) and on the other hand this binds the principal to the agent and secures the agent’s income.

The FED already changed their regulation: it’s not a requirement anymore that their assets are rated – it is sufficient if the firms show that they have their own models (Schweizer Fern-sehen – ECO 2008). That’s at the moment the trend: big financial service companies tend to start their own rating business units. That’s basically an attack on the existence of the rating agencies.

Another point that needs to be tackled is the transparency of rating agencies. A lot of things are kept secret although the rating agencies play a key role in the financial market. They don’t offer insights in their internal processes and how they interact with their customers. Again this can be improved with more regulations.

The main side effect of all the above proposed improvement solutions is that the business environment certainly will begin to get worse for the rating agencies and the whole invest-ment world. But to be on the safe side it’s certainly worth it.

4.3.4 Conclusion

The parties in the above describe relationship have an alignment of interest but there is not an equal spread of risk. The relationship contains a lot of moral hazard and therefore the out-come of the analysis supports the first hypothesis (3.2.2). There’s not only one culprit – the whole system supported this kind of business for several years. Afterwards we can see what went wrong and how to prevent that this will happen again. All three elements of the research questions (risk aversion, moral hazard and blind confidence) apply to this relationship.

Basically we can say that with adjusting parameters to improve the best estimate for a rating you don’t improve your worst case – and that what some entities lost out of sight.

4.4 Relationship “AIG Financial Products (Joseph J. Cassano) – Consultant (Gary Gorton)”

There were possibly several consultants working for AIG. In general, a consultancy mandate is a potential source for agency problems. This is, because a consultant is often hired on base of his or her knowledge in a specific area, this means that the knowledge is asymmet-ric. A factor may be that independence and the resulting objectiveness motivates a company to demand consultancy, but there lies danger of hidden characteristics and hidden intentions, as the consultant is not part of the company, therefore difficult to observe and harder to align the objectives. If a neutral view is the only motivation of considering an external consultant, eventually the situation is already problematic, because obviously internal experts are not able to find a solution, experts do not agree or there is a lack of confidence. Another reason to demand consultancy may be to legitimate a decision someone tends to anyway. These are maybe less problematic cases in terms of agency problems, as far, as the recommenda-tion is as expected.

In this chapter we will discuss the relationship of the AIG financial products department, rep-resented by the head of department, Joseph Cassano, to a specific consultant, Gary Gorton.

Gorton's notable role was especially put up for discussion by The Wall Street Journal by the end of October (Mollenkamp et al., 2008). Consultant (Gary Gorton) Principal Agent AIG Financial Products

(Joseph J. Cassano)

Gary Gorton is seen as agent and Joseph Cassano is regarded as principal. This is the most obvious constellation because Mr. Gorton was getting paid by AIG for his consulting work and his risk evaluation models. If we look at some statements (e.g., that his models con-vinced the principal of a business), we could guess, that Mr. Gorton was interested in apply-ing his theories, as practical success is often the only way to approve a business theory. Thus we could look at AIG as the agent who fulfils this practice. But we will rather deal with that motivation as an agent problem, where the motivation of the agent is not completely align with the objective of the principal.

Gary Gorton's curriculum vitae (Gorton, 2008) shows several studies, e.g. in Chinese, litera-ture and economics, also the PhD in economics. His "current positions" include functions at the Wharton Financial Institutions Center and the National Bureau of Economic Research, he is Professor at the University of Pennsylvania and since July 2008 Professor of Finance at Yale University. There is also an impressive list of academic research experience, including several schools and financial institutions, surprisingly AIG is not mentioned. According (Mol-lenkamp et al., 2008) "Mr. Gorton joined as a consultant in the late 1990s". He was calculat-ing the risk models based on which credit default swaps where sold.

Some possible roles Gorton played in the AIG are the following selected from Saam (2002, p. 92), who mentions several (primary and support) functions a consultant may have in a company:

- Transfer function: bring in knowledge or know-how - Catalysis: moderate or stimulate solutions

- Legitimation: support the basis for pre-decided actions - Garnish: cause gain of prestige to the principal

With his scientific background, Gorton could bring some knowledge to AIG. With his credibil-ity he was able to stimulate solutions, it is conceivable, that Cassano was interested in doing new businesses and needed a credible expert to base his decisions on and it was also inter-esting to have a well known professor on board. Maybe this fact also helped to convince cus-tomers as Gorton directly communicated to investors according The Wall Street Journal (Mollenkamp et al., 2008).

4.4.1 Goals and Measures

The goals of J. Cassano seemed to be simply profit. According The Wall Street Journal (Mol-lenkamp et al., 2008), Cassano was getting convinced, that Credit default swaps "were only gold, that if anybody paid you to take on these risks, it was free money". Out of this state-ment, one could guess, Mr. Cassano was driven by the greed of gain and was willing to for-get all risks for that (see also chapter 4.1). However, to make profit is the goal of any com-pany (aside from explicit non profit organisations). The concrete objective and thus expecta-tions in the agent is seen as getting a reliable basis to decide on concrete affairs.

There is no clear information on the agreements between AIG and Gorton. According The Wall Street Journal (Mollenkamp et al., 2008) "Mr. Gorton billed AIG about $250 an hour". So we can say, Gorton had to calculate risk models and was paid for that on an hourly basis. More information on his role, arrangement and measures is not given: "Mr. Gorton, who con-tinues to be a paid AIG consultant, referred questions about his role to AIG" (Mollenkamp et al., 2008) and AIG did not comment that question. So, obviously he complied with his tasks or AIG cannot blame him or is otherwise depending on Gorton.

4.4.2 Problematic Nature of the Relationship

Adverse selection in the sense of how to get the right consultant for the position of Gorton is not traceable. Regarding the business itself, Gorton’s work was the basis to decide on the selection of securities portfolios to insure. Therefore that work can be considered as mean to avoid adverse selection of portfolios.

It is hard to say, who had which information and who not. Sure, Gorton had the deeper knowledge on the derivative products in the beginning of the CDS business. It was already mentioned that his work seemed to be the driving power leading to that business. One could say that Mr. Gorton, as financial expert must have known, that financial crisis is possible but this is also true for managers in the financial sector. According (Benders, 2008) specialists knew and have ignored, that the models do not consider potential collateral calls in falling markets1.

As the expert and intellectual godfather of the models, there was possibly even though a lot of space for Gorton. The less detailed the management knew the models the smaller their control and possibly they knew the models only as detailed, as Gorton explained them. At least for a certain time, it was not possible to know, whether the models are really good or if just the market situation or a piece of good luck brought success.

Thus Gorton probably had a lot of possibilities in terms of hidden action. For example it was surely hard for the management to retrace the exact working time Gorton really needed for the models. If for example Gorton says that some calculations have to be proven or changed again, who could verify this?

1

"Dabei hatten die Spezialisten aber wider besseren Wissens ignoriert, dass das Modell die Nachforderungen von Sicherheiten (Collaterals) durch

We cannot know whether it was an intention of Gorton, but his work may have lead to a kind of hold up problem or at least dependency where Gorton possibly gained a certain freedom in charging his efforts. According (Mollenkamp et al., 2008) there are estimates that he earned up to $1 million a year. Of course he knew his models to calculate risks best.

Fromme (2008) mentions the problem that the boards of management do not understand risk models completely and thus not whether they cover all risks. Although Mr. Gorton said (Mol-lenkamp et al., 2008) "the models are all extremely simple", to break off the relationship with Gorton would possibly mean that AIG has a decision basis (the models) which they possibly do not fully understand and therefore cannot maintain them.

For sure the risks of loss through failures of the risk models bore by Cassano and Gorton where unequal. No fact was retrievable, that Gorton had a disadvantage of the AIG crisis: he is still working for AIG and is, as already mentioned, professor at Yale. In contrast, Joseph Cassano lost his position at AIG, even though he meanwhile had earned a huge amount of money. At least, a manager is responsible for leading a company to success, whilst a con-sultant normally is not responsible but advices companies. In the context of risk in terms of losses, we should possibly not speak of Joseph Cassano but about AIG itself or even the US citizens, who pay for the losses with their tax now.

When looking at Mr. Gortons reputation and persuasiveness and the motivation assumed, combined with the mentioned hidden information and possibilities of hidden action he had, some moral hazard can be implied. It is possible, that Mr. Gorton for example calculated the models in a way, that the business seemed very lucrative. If he had calculated every possible risk, AIG would possibly not have been interested in selling the swaps. This means, with the highest probability, the business was profitable and therefore Gorton was able to proof his theories. His contracts apparently left him that space. With the given impact of Gorton, one could recon that he would have had the power to hinder the business by making plausible, that the effective worst case risk is too high. But he obviously had no responsibility or dis-profit depending on the success of the business leading him to do so.

It is not clear, whether the main consequences, the crisis of AIG, is a consequence of the moral hazard of Cassano or Gorton, as Gorton did not decide but provided the basis for de-cisions. And apparently critical decisions relied on the models. According (Mollenkamp et al., 2008) Gorton told investors at a meeting, that no transaction would be approved if it was not based on a model they built.

4.4.3 Solutions to Improve the Relationship

However, bearing no visible risks at least did not force Gorton to enforce more extensive risk management. In the following, it will be tried to derive means to avoid possible risks and be-haviors in relations of the given kind.

Some approaches to proactively avoid agency problems beginning with the selection of a consultant are mentioned in (Saam 2002, 76), primarily regarding hidden characteristics: A consultant firm should not always follow the latest consultancy methods and should not sell only own consultancy concepts. Also to include restrictions regarding project controlling in the consultancy contract is mentioned. With respect to the selection of consultants Saam (Saam 2002, 74) mentions approaches which also may avoid adverse selection, these in-clude: A bid invitation followed by an evaluation of competencies and reliability of the consult-ing firms. In a "bid conference" the bidders have to present themselves and also the actual consultant which is planed to be deployed. An interesting version is to combine the bid invita-tion with the strategy of deploying different consultants for different subprojects, what leads to a certain competition ex ante and ex post.

There is no information available on how Gorton became his consulting function at AIG and what details his contract contains. Furthermore these hints focus mainly on regular consul-tancy companies. Thus, not all approaches apply the given relationship.

In the given relation it was seen as problem, that AIG became dependent on Gorton. Thus the solution should hinder dependence on a single consultant. The mentioned point about selling own consultancy concepts is related to this, because the consultant knows the con-cept best and therefore he not only gains a specific power and freedom of action but applying his concept may also mean, that the course of action cannot be changed freely. This is seen as potential for a kind of hold-up problem or risk of sunk cost. In the case of Gorton, it is not the consulting concept but the content of work which gives him an indispensable position. As proposed solution to prevent agency problems in the given kind of relationship, some means are derived from the mentioned approach of having different consultants for different subprojects, including a selection strategy. Additionally some contracting features have to be implemented. The following propositions strongly rely on the necessity to cooperate and compete, independent of whether subprojects are built.

Consultant selection

When selecting a consultant, a company always has the problem of hidden characteristics. A screening by general research on consultants or consulting companies accompanied with a kind of conference, where all possible candidates are present, gives the principal the chance of recognizing competencies, reliability and relations between the candidates. In the case of Gorton, we have a long term relation, where resulting agency costs seem reasonable.

Competing cooperative consultancy

dis-cussed in the following paragraphs. Examine all potential risks of this approach and how to handle them goes beyond the scope of this work, however some obvious problems are the following: There exists a risk that agents work together against the principal's objective. Addi-tionally it becomes more difficult to assign the responsibility for results to a person, as the agents review and examine each other. Of course, by applying this solution there remains a dependency, but not from a single person anymore. As a matter of course, the approach is also more expensive for the principal, as two consultants have to be paid and the process of reaching consensus may take additional time. In the given case, the importance of quality and the relevance for business success may legitimate the latter fact.

Consultancy contract

"AIG executives, not Mr. Gorton, decided which swaps to sell" (Mollenkamp et al., 2008). Without liability a consultant is free to experiment. As long as no arbitrariness can be at-tested, no one can condemn a consultant's work. In the case of a scientist like Gorton, one would suggest, he always relies on research theories and is able to legitimate his actions. As (Fromme 2008b) says, Gorton calculated the risks conform to his mandate, but not consider-ing all risks.

It is hard to assign much responsibility to a consultant. Responsibility requires power of deci-sion. It cannot be a company's goal to let external entities making major decisions.

Tying payment to performance is difficult in the given case. First of all, if there had been per-formance measure dependent on the profit of the businesses which relied on the risk models, Gorton would have had won for years. Actually AIG has successfully sold CDS from 1998 to about 2007. Secondly the measure also would have been weak, because Gorton did not de-cide on which portfolios to hedge, not on the price and not on reassurance. Thirdly, if the risk for Gorton would have been very high, he would have presumably abstained to the mandate. Fourthly, if the incentive would be only on a monetary basis, it is unclear whether it would work for a person like Gorton and even if it worked, it is possible for an external consultant, that he follows also another mandate and lies more effort in that one. A measure which was more depending on Gorton's effort is the quality in terms of correctness of his models. The concerns of effectiveness mentioned before remain but the main problem seen is to proof the quality, as we speak of probability calculations. Also (Saam, 2008, 83) mentions several pay-ment systems but even performance fees are not seen as effective against hidden action problems in consultancy. Some other means are control based, as for example including employees in the consultants work. In our case this was only possible, if an employee has the deep knowledge of Gorton, thus the function of Gorton would be reduced to some gar-nish function. Additionally an employee could be perceived as observer whereas a second scientist would possibly more act as scientific challenger.

Such a contract binds the consultant, exposes him to the risk of being not able to fulfill a cer-tain task and therefore lead him to act towards the expected goal. Agents seeing themselves not capable may not agree such a contract.

Regarding payment, a fixed sum for a specific output may reduce the risk for the principal that the agent charges more hours than necessary. But the agent could argue with unfore-seen problems. There was a risk in aborting the relation for both parties: for the agent to get no payment for the efforts and for the principal in this case to have invalid models.

Regulations

Neither governmental nor firm internal regulations are seen as instrument against agency problems in the given case, at least not directly. Internal regulations could help indirectly, e.g. a regulation concerning contracting guidelines like described above or regulations concern-ing risk management which therefore would deter the management to rely on incomplete de-cision basis.

Feasibility

In this chapter some approaches where proposed and discussed regarding the expected ef-fects and side efef-fects. Finally we have to ask, if a consultant or scientist is interested to enter a relation with the given conditions. The main difficulty is seen in the cooperation. Possibly a scientist who is concerned on his theories does not want to follow compromises forced by a colleague who does not completely share the beliefs. But if a scientist is not able and willing to question, discuss and defend his theories, we may become in doubt of his credibility. Simi-larly we can argue regarding the willingness to join a selection process. In the third proposi-tion, the consultant has the risk that a failure gets public. In this case we could argue that, if a scientist is not convinced of his work or capability to reach the goal, the principal should con-sider another consultant. If none of the candidates seems to be capable, or if two experts do not find a common solution, the principal should consider that the task is possibly not to han-dle and maybe rethink the business and its risks. In our case, the main goal assumed, namely to proof his theories, Mr. Gorton could still follow.

4.4.4 Conclusion

5 Overall

Conclusion

The analyses of principal-agent relationships have shown, that it is often difficult or, at least for uninvolved people, even impossible to prove cases of moral hazard or averse selection. However, the cases have shown that hidden information and hidden actions were possible and, combined with low risks, at least presumably led to moral hazard. We cannot blame a single agent's or principal's behavior for the disaster of AIG. But seen the described relation-ships as well as other factors as a whole, we conclude that spreading the risks, applying more responsibility and enforce regulations regarding calculation of transaction risks can at least reduce the danger of falling in a situation like the AIG. Thus the hypothesis are con-firmed by this work, not evidenced but at least not refuted. Whilst the first hypothesis, that risk must be shared up between principal and agent, are supported by all of the concrete re-lationships, risk guidelines are mainly reckon as helpful regarding AIGFP, namely Joseph Cassano as responsible person for taking over large risks.